Nevada Senator Introduces Bill to Repeal Gambling Deduction Decrease, But Fails to Do So Under Unanimous Consent

By Robert Linnehan in Sports Betting News

Published:

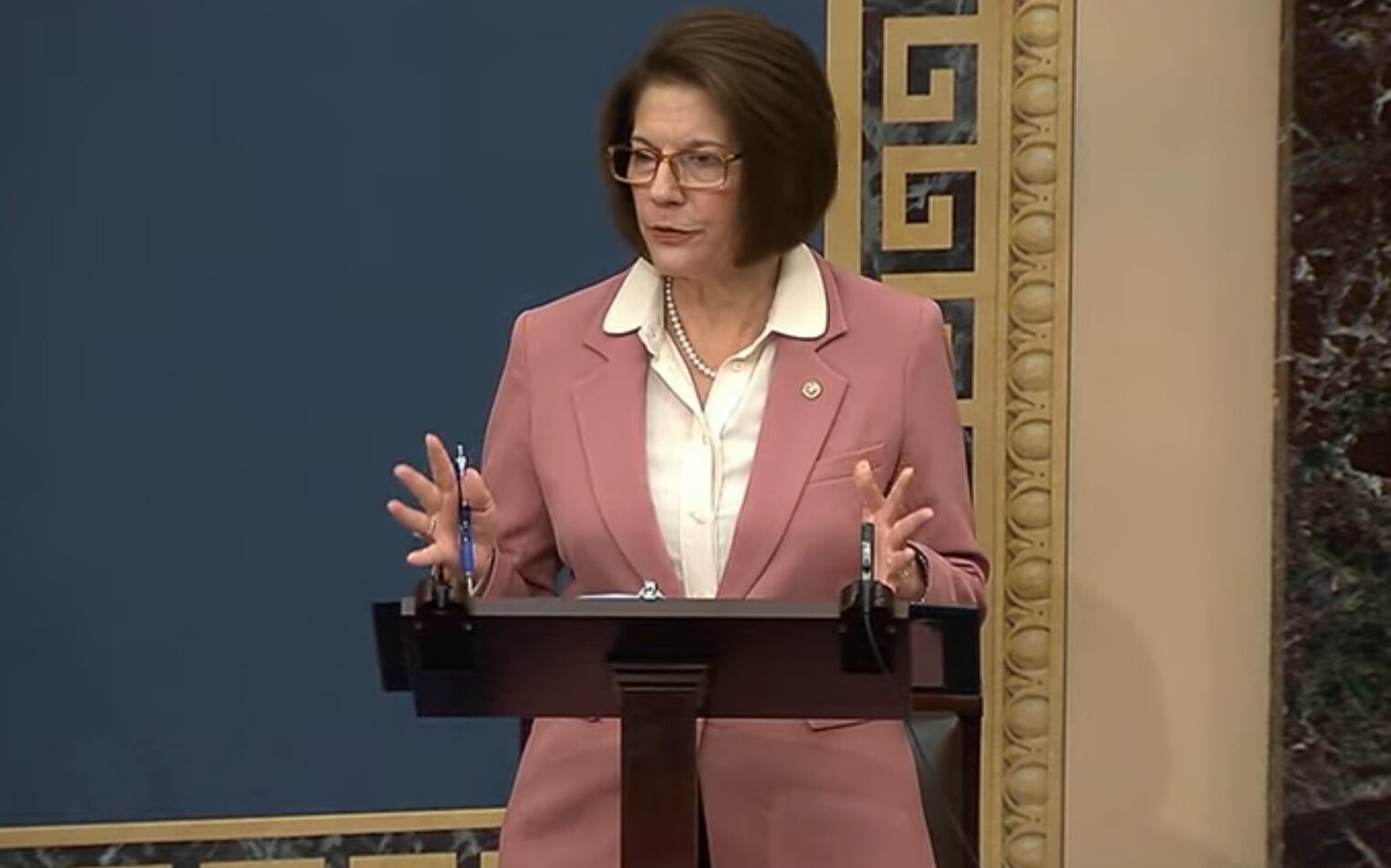

- Sen. Catherine Cortez Masto (D-Nevada) today introduced the FULL HOUSE Act

- The bill will repeal the gambling deduction decrease in the One Big Beautiful Bill Act

- It’s the second introduced bill from a Nevada politician this week to repeal the gambling deduction decrease

Nevada politicians are cornering the market on bills to repeal the federal gambling deduction decrease included in President Donald Trump’s (R) One Big Beautiful Bill Act.

Sen. Catherine Cortez Masto (D-Nevada) today introduced the Facilitating Unbiased Loss Limitations to Help Our Unique Service Economy (FULL HOUSE) Act, which will restore a professional gambler’s ability to deduct 100% of gambling losses – as long as it does not eclipse their winnings – on their federal tax returns.

Cortez Masto introduced the bill today on the Senate floor via unanimous consent, but the legislation did receive an objection. Cortez Masto will now have to go through the formal voting procedure to pass her bill.

Second Bill Introduced This Week to Overturn Wagering Loss Deductions

Cortez Masto’s bill, S2230, is one page long and amends the section of the One Big Beautiful Bill Act that only allows professional gamblers to deduct 90% of their losses on their federal tax returns.

Trump’s bill, Cortez Masto said during a Senate hearing today, will be detrimental not only to Nevada, but to the U.S. gaming industry as a whole. It will push customers to unregulated black markets and unfairly punish the Nevada tourism industry.

“This ridiculous gaming tax is something we can fix today. This provision being included in the tax bill is a result of Republicans haphazardly inventing new budget rules to ram their debt busting bill through Congress. These new rules they made up forced them to make changes to existing policy, even if it made that policy worse for Americans, and that’s what happened here,” Masto said during a Senate hearing today.

Sen. Todd Young (R-IN) formally objected to the request for unanimous consent of the FULL HOUSE Act. Young requested Cortez Masto amend her bill to also restore tax exemptions for certain religious institutions that were stricken from the One Big Beautiful Bill Act, which Cortez Masto declined to include.

Cortez Masto will now how to go through the formal approval process to legalize her bill.

“I’m disappointed, but I am not done. I promise you this, we’ll continue to work to the S2230 passed, it’s just common sense. It has bipartisan support here in the Senate,” Cortez Masto said.

Criticism for One Big Beautiful Bill Act

Trump’s sweeping legislation was approved on Thursday, July 3, with the president signing the bill into law on July 4.

Included in the massive piece of legislation was a new tweak to the Internal Revenue Code, which only allows professional gamblers to deduct 90% of their losses in a year, down from 100%.

However, this overhaul of the Internal Revenue Code received ire from professional gamblers who said it will force users to flock to the black markets for their gaming purposes. It unfairly punishes those who accurately report their gambling wins to the federal government each year, many said.

Additionally, HuffPost reported that numerous Republican Senators had no idea the provision had even been included in the bill.

“If you’re asking me how it got in there, no, I don’t know,” Sen. Chuck Grassley (R-Iowa) said during an interview with HuffPost earlier this week.

Cortez Masto alluded to this, as she noted during her bill introduction that she’s “not sure any of my Republican colleagues even knew this was in the bill they passed.”

Nevada Representative Counterpart Also Introduced Bill

Cortez Masto’s Nevada counterpart in Congress, Rep. Dina Titus (D-Nevada) also introduced a similar bill this week.

Titus, along with Rep. Ro Khanna (D-CA), introduced the FAIR BET Act, which will restore the provision that allows professional gamblers and sports bettors to deduct 100% of their losses from their taxes.

“It pushes people into the black market if they don’t do regulated gaming because they have a tax disadvantage. The black market doesn’t pay taxes, it isn’t regulated, doesn’t help with problem gaming. It’s bad for the industry and it’s bad for the player,” Titus said during an appearance on News Nation.

Titus today said on her social media channel she is unsurprised the bill did not receive unanimous consent. The best chance for the repeal, she said, is for both chambers to unite behind her FAIR BET Act.

Regulatory Writer and Editor

Robert Linnehan covers all regulatory developments in online gambling and sports betting. He specializes in U.S. sports betting news along with casino regulation news as one of the most trusted sources in the country.