Operators Urging Michigan Users to Oppose Proposed Tax Hikes

By Robert Linnehan in Sports Betting News

Published:

- FanDuel, DraftKings, and BetMGM have sent emails to Michigan customers asking them to oppose a proposed state sports betting and iGaming tax hike

- The email asks customers to tell Michigan legislators they oppose the new tax rates

- Patrons are directed to the Sports Betting Alliance website to fill out a form to send to Michigan legislators

A proposed iGaming and sports betting tax rate increase in Michigan has licensed gaming operators reaching out to their Great Lakes State customers to combat the proposed hike.

FanDuel, DraftKings, and BetMGM all sent similarly worded emails to Michigan users this week urging them to contact their state legislators to oppose two proposed bills that would slightly increase both the iGaming and sports betting tax rates in Michigan.

The proposed legislation would increase the state’s sports betting tax rate by 0.1% and increase the various iGaming tax rate levels by 1% each.

Proposed Bills Will Increase Rates

Sen. Sam Singh (D-28) and Sen. Jeremy Moss (D-7) co-authored and introduced bills SB 1193 and SB 1194 on Dec. 5. SB 1193 proposes increasing the state’s adjusted sports betting tax rate from 8.4% to 8.5%, while SB 1194 proposes a 1% iGaming tax rate increase to each of its iGaming adjusted gaming revenue tiers.

Both bills currently reside in the Senate committee on government operations.

If approved, the new iGaming tax rate tiers for state operators will be as follows:

- Less than $4 million in annual adjusted gaming revenue: 21%

- $4 million to less than $8 million: 23%

- $8 million to less than $10 million: 25%

- $10 million to less than $12 million: 27%

- $12 million or more: 29%

Both proposed bills also slightly alter how gaming tax revenues would be distributed in the state. The sports betting bill will allocate 31% of sports betting tax revenues (up from 30%) to the city in which the sports betting operator’s casino is located. It would decrease the percent of tax revenues to the state to 63.5%, down from 65%, if approved. It would increase revenues to the Michigan agriculture equine industry development fund to 5.5%, up from 5%, as well.

The iGaming bill, similarly, would reduced the state’s cut from 65% to 64.5% for iGaming tax revenue, while also increasing the Michigan agriculture equine industry development fund’s cut to 5.5%, up from 5%.

Call to Action in Michigan

The emails urge state customers to reach out to their respective legislators to ask them to not support the legislation. The operators note the increased tax rates may lead to decreased promos and bonuses, worse odds, and could put hundreds of potential new jobs in the state in jeopardy.

They were sent from DraftKings, BetMGM, and FanDuel, three of four operators that make up the Sports Betting Alliance. A Fanatics Sportsbook representative said the operator did not send emails to its customers in Michigan, but does oppose the increases.

“Like all members of the Sports Betting Alliance, Fanatics Betting and Gaming believes that major legislative policy discussions like increasing tax rates on the industry should require extensive deliberation and discussions. While we did not engage our customers directly on this issue, we support the advocacy efforts of the other member companies,” the spokesperson told Sports Betting Dime.

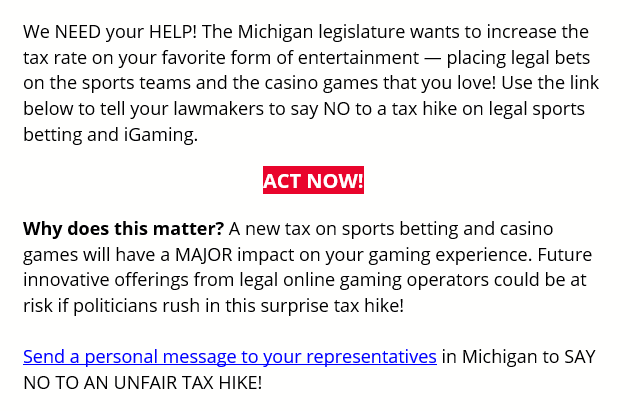

The emails from each operator are worded as such:

The emails end with a link to the Sports Betting Alliance, which allows users to fill out a form to be sent to their respective state legislators.

“I’m reaching out because raising taxes on legal sports betting and iGaming will only hurt fans like me who just want to enjoy games how we want. Senate bills 1193 and 1194 would increase the tax burden on this industry, hurting fans like me and putting hundreds of new local jobs at risk. That’s not the Michigan way. Let’s protect our freedom to enjoy the games we love without more taxes. Please let us continue enjoying the games as they are,” the form reads.

Regulatory Writer and Editor

Rob covers all regulatory developments in online gambling. He specializes in US sports betting news along with casino regulation news as one of the most trusted sources in the country.