Odds to Win the Streaming Video-on-Demand War

By Sascha Paruk in Entertainment

Published:

- A number of media giants are slated to enter the streaming-video competition in the next year

- Will NetFlix and Amazon Prime be able to fend off the likes of Disney, Apple, and Warner?

- Get the odds on their subscribers at the end of 2020 and which new entrant will reach the 50-million mark first

The battle for your eyeballs is about to get vicious. The success of streaming video-on-demand (SVOD) services, like NetFlix, Amazon Prime, and Hulu, has led established media giants to an inevitable conclusion: we need to board this lucrative ship before it leaves for planet money without us.

In the next 12 months, Disney+, Apple TV Plus, and HBO Max are all going to enter the streaming video-on-demand fray, along with a yet-unnamed service from Comcast NBCUniversal.

The influx of competitors is going to leave the existing streaming kingpins defending their turf and it’s going to be an all out war for subscribers. Think “the Hunger Games for streaming services”, says an article in Bloomberg Weekly.

We’ll get into a more fulsome discussion, below, but here’s where we see subscription numbers sitting at the end of 2020. (What’s the opposite of burying the lede?)

Streaming Video-on-Demand Odds & Projections

| Streaming Services | Over/Under Subscribers by Dec. 2020 |

|---|---|

| NetFlix | 170.5 million |

| Amazon Prime | 115.5 million |

| HBO Max | 14.5 million |

| Disney+ | 13.5 million |

| Apple TV Plus | 9.5 million |

NetFlix Remains King, For Now

As of April 2019, online SVOD subscribers numbered about 500 million in total. Sounds like a lot, but it’s only about half the number of digital pay TV users (i.e. cable and satellite), which was roughly one billion, according to vox.com.

Of that 500 million, NetFlix accounts for just over 30%. The streaming pioneer numbered close to 160 million subscribers in late 2019.

Concerningly for NetFlix, it is already losing ground and seeing its stock price sink. NetFlix’ stock price reached a high of $385 USD on May 3, 2019, but closed at just $281 on Oct. 28. That followed a quarter in which is raised rates, lost subscribers, and reported less-than-expected earnings.

NetFlix is still going to be the industry leader by the end of 2020, though; you can count on that. The company remain committed to both buying up and developing quality content. Part of the reason their bottom line is not what it could be is because of how much they spend on production and acquisition.

It remains to be seen how that pans out in the long run in terms of corporate health, but over the next 14 months, it’s going to maintain the company’s big lead in subscriptions.

Next SVOD Service to Reach 50 Million Subscribers

| Streaming Service | Odds |

|---|---|

| Disney+ | 1/2 |

| Apple TV Plus | 5/1 |

| HBO Max | 6/1 |

| NBCUniversal | 40/1 |

HBO Will Start Fast, Disney Is Built to Go the Distance

When it comes to which of the new entrants will be the quickest off the block, expect Disney to trail HBO Max initially. But the Magic Kingdom will reach that magical 50-million mark the soonest. The brains behind HBO Max believe that they will have a sizable portion of HBO’s existing 38 million subscribers sign up for HBO Max for just a couple dollars more. (HBO is $15/month, and Max is expected to be about $17/month.)

But Disney seems very committed to this whole streaming thing. The company already owns a sizable stake in Hulu, and is investing heavily in Disney+. On top of that, they have a massive library to cull from. So when Disney+ is first made available (Nov. 12th), the selection is likely to be excellent, both in quantity and quality. That stands in stark contrast to Apple TV Plus.

Apple TV Plus Will Be … Cheap

Apple TV Plus is going to cost just $4.99 per month! That’s the good news. Now for the bad.

It’s going to have nine shows to start out. Yes, nine. They’ll hit double digits about a month later, according to CNET.

Those nine shows may garner quite a number of viewers, because buying most Apple devices is going to get you a year of free Apple TV Plus access. But those viewers don’t count as subscribers. Apple is not positioning itself well to win this marathon, though they may start quickly.

Current Subscription Statistics

| Streaming Service | Number of Subscribers |

|---|---|

| NetFlix | 158 million |

| HBO | 140 million |

| Amazon Prime | >100 million |

| Hulu | ~30 million |

Amazon Prime Is Well Protected

Amazon Prime is rivaling NetFlix and HBO in terms of the number of subscribers — it actually outpaces both already in just the US — and is growing steadily. You might think that would make it a likely target for regression, but remember that Amazon Prime is a lot more than streaming video. Only about a quarter of the Prime subscribers were using the video-on-demand part of the service circa Nov. 2018, according to Stephen Lovely.

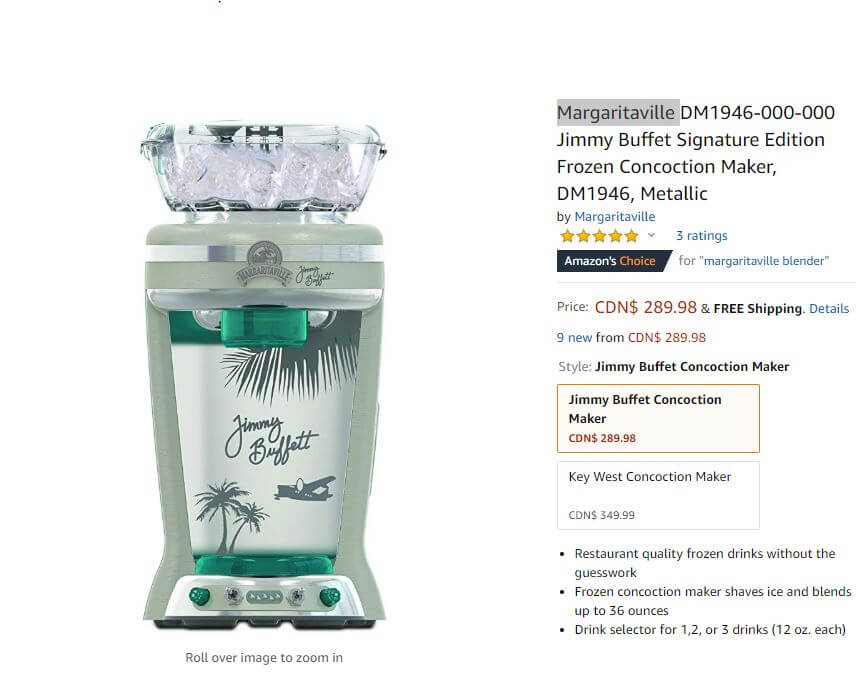

Prime’s diversified portfolio, which includes free two-day shipping on anything purchased from Amazon.com, renders it a lot more resistant to an influx of new streaming services. My desire to watch the new Jennifer Aniston vehicle on Apple TV Plus does nothing to quell my need for a Margaritaville Frozen Concoction Maker, Jimmy Buffett Anniversary Edition.

For us, the general public that simply wants quality content and a reasonable price (ideally free), the increased choice can only be seen as a positive. At the current and estimated rates, it will be entirely possible to subscribe to multiple SVOD’s on a modest budget.

And the media conglomerates better hope that we do, because there won’t be room for upwards of five SVOD services in the North American market if households are limiting themselves to one apiece.

Managing Editor

Sascha has been working in the sports-betting industry since 2014, and quickly paired his strong writing skills with a burgeoning knowledge of probability and statistics. He holds an undergraduate degree in linguistics and a Juris Doctor from the University of British Columbia.