New York sports betting revenue was falling far short of its potential due to the state’s slow approval of online gambling. Online NY sports betting went live on January 8, 2022, and state revenue should increase dramatically now that mobile wagering is available.

The Empire State’s fortunes should skyrocket now that online sports betting is off the ground.

This page will keep you informed with the most important details and analysis of monthly New York sports betting revenue reports. Here’s everything you need to know about the business of sports betting in the Empire State.

New York Sports Betting Revenue: Month-By-Month Data

Sports Betting Dime keeps track of the growth of legal sports wagering by tallying monthly financial reports provided by each state.

Here’s what each number represents:

- Revenue reflects the gross gaming revenue kept by sportsbooks after paying out winning bets.

- State tax revenue displays taxes collected by the state and local jurisdictions.

- Hold percentage shows how much revenue sportsbooks kept as a function of the betting handle.

- State tax revenue displays taxes collected by the state and local jurisdictions.

The table below shows New York’s online sports betting handle, gross revenue, hold rate, and state taxes collected each month since legalization.

| Month/Year | Total Handle | Revenue | Hold Percentage | State Tax Revenue |

|---|---|---|---|---|

| January 2022 | $1,669,719,034 | $124,138,955 | 7.4% | $63,310,867 |

| February 2022 | $1,534,078,894 | $81,424,598 | 5.3% | $41,625,972 |

| March 2022 | $1,644,789,692 | $114,956,204 | 7.0% | $58,351,264 |

| April 2022 | $1,396,791,941 | $104,535,898 | 7.5% | $53,151,656 |

| May 2022 | $1,269,862,570 | $110,418,075 | 8.7% | $53,859,457 |

| June 2022 | $1,056,694,012 | $72,441,500 | 6.9% | $36,936,704 |

| July 2022 | $804,966,381 | $73,880,416 | 9.2% | $37,449,745 |

| August 2022 | $877,407,454 | $100,760,793 | 11.5% | $50,912,978 |

| September 2022 | $1,265,553,630 | $145,039,867 | 11.5% | $73,270,471 |

| October 2022 | $1,555,051,007 | $146,845,938 | 9.4% | $74,403,029 |

| November 2022 | $1,564,144,673 | $149,244,901 | 9.5% | $75,695,441 |

| December 2022 | $1,632,469,010 | $142,969,451 | 8.8% | $72,422,558 |

| January 2023 | $1,799,048,366 | $149,886,749 | 8.3% | $76,253,908 |

| February 2023 | $1,466,956,555 | $108,281,940 | 7.4% | $55,223,789 |

| March 2023 | $1,785,952,977 | $162,827,580 | 9.1% | $83,042,066 |

| April 2023 | $1,544,465,378 | $138,820,564 | 8.9% | $70,798,487 |

| May 2023 | $1,358,583,506 | $151,968,098 | 11.1% | $77,504,076 |

| June 2023 | $1,166,390,859 | $103,827,784 | 8.9% | $52,952,170 |

| July 2023 | $962,126,094 | $105,132,318 | 10.9% | $53,617,482 |

| August 2023 | $1,112,768,221 | $98,504,385 | 8.8% | $50,237,236 |

| September 2023 | $1,759,236,826 | $165,562,104 | 9.4% | $84,436,673 |

| October 2023 | $2,006,823,408 | $166,328,229 | 8.2% | $84,827,397 |

| November 2023 | $2,109,294,400 | $150,903,281 | 7.1% | $76,960,673 |

| December 2023 | $2,041,931,893 | $188,300,120 | 9.2% | $96,033,061 |

| January 2024 | $1,955,590,364 | $211,504,815 | 10.8% | $107,867,456 |

| February 2024 | $1,773,303,032 | $131,427,395 | 7.4% | $67,027,972 |

| March 2024 | $1,849,080,276 | $151,679,658 | 8.2% | $76,281,884 |

| April 2024 | $1,964,058,932 | $183,791,666 | 9.3% | $93,733,750 |

| May 2024 | $1,972,946,780 | $203,347,519 | 10.3% | $103,707,235 |

| June 2024 | $1,473,071,481 | $133,931,080 | 9.1% | $68,304,851 |

| July 2024 | $1,261,967,679 | $140,328,926 | 11.1% | $71,568,040 |

| August 2024 | $1,436,142,323 | $124,999,776 | 8.7% | $63,750,301 |

| September 2024 | $2,071,515,109 | $204,710,934 | 9.9% | $104,439,638 |

| October 2024 | $2,321,095,638 | $176,346,919 | 7.6% | $89,936,929 |

| November 2024 | $2,265,089,204 | $231,570,118 | 10.2% | $118,100,760 |

| December 2024 | $2,280,644,347 | $150,367,034 | 6.6% | $76,852,731 |

| January 2025 | $2,480,723,678 | $247,046,629 | 9.9% | $149,022,555 |

| February 2025 | $1,975,603,982 | $184,812,648 | 9.4% | $94,254,450 |

| March 2025 | $2,439,979,634 | $183,791,666 | 7.5% | $82,535,829 |

| Total (since launch) | $65,065,888,523 | $5,701,935,635 | 8.8% | $2,930,148,295 |

Sports Betting Dime will update this table monthly with the New York State Gaming Commission’s figures.

NY Sports Betting Revenue: Annual Figures

The New York market has seen slow but steady growth since its launch in June 2019, and now that online sportsbooks are available, the state won’t underperform its potential anymore.

The table below displays annual financial figures for New York’s retail sports betting industry.

| Year | Revenue | State Tax Revenue |

|---|---|---|

| 2019 | $7,783,426 | $778,344 |

| 2020 | $10,768,736 | $1,094,832 |

| 2021 | $197,476,663 | $23,321,150 |

| 2022 | $1,341,379,003 | $746,554,132 |

| 2023 | $1,689,883,800 | $861,840,738 |

| 2024 | $2,044,005,840 | $1,042,442,978 |

Despite being shut down for five months due to coronavirus-related challenges, the Empire State recorded $10 million in sports betting revenue in 2020, a year-over-year growth of 38 percent.

Expect to see explosive growth now that the state has gone-live with online sports betting.

Latest NY Revenue News

Here’s a quick synopsis of the latest news from New York sports betting financial reports.

As we eagerly await the report with figures from the first month of NY online sports betting, the Empire State has declared totals from the opening weekend of mobile wagering. According to the New York Fiscal Year 2023 Budget Briefing Book, over $150 million in total wagers was collected through the first weekend of betting with NY sportsbook apps.

- April 2022: For a fourth straight month, the Empire State collected over $1 billion in total wagers through April 2022. New York has now crossed the $200 million in total state tax sports betting revenue.

- March 2022: New York collected over $1.5 billion in total wagers for a third-straight month, with a monthly sports betting handle in March of $1,644,789,692. New York sports betting revenue also recovered this month, coming in at $114,956,204 off a 7% hold rate.

- February 2022: The Empire State continues to pull in massive sports betting figures every month, as New York collected $1,534,078,894 in total wagers through their first full month of betting in February. A smaller hold percentage resulted in a revenue dip, however, as the state earned $40 million less this month at a total of $81,424,598.

- January 2022: It only took three weeks for New York to break the monthly sports betting handle record, as the state reported $1.6 billion in total betting handle from January 8 to January 30, 2022.

- December 2021: In the final month before the launch of New York sports betting apps, the Empire State recorded $21,129,981 in total wagers. This figure will be astronomically higher through the next month as online sports betting gets underway on January 8, 2022.

- November 2021: After a slow month in October, New York sports betting revenue reached a new height in November 2021. The state collected $3,956,490 in revenue through November, setting a new record as online New York sports betting approaches.

- October 2021: New York sports betting revenue dipped drastically in October 2021, going from $3 million a month earlier down to $1,718,614. These figures should improve drastically once online New York Sports Betting gets underway on January 8, 2022.

- September 2021: The start of the NFL season gave the retail NY sports betting industry a much needed boost, as gross gaming revenue soared to $3,187,045. As a result, monthly net revenue tripled to a total of $318,705.

- August 2021: The gross gaming revenue in the Empire State continued to dip in August, reaching a total just above the $1 million mark. The state hovered above the $100,000 figure for net revenue yet again in the month of August.

- July 2021: New York’s gross gaming revenue drops 31 percent month over month to $1,273,621. July was a noticeably quiet month for the sports betting industry across America, but betting volume is expected to soar again in late summer with the return of NFL and college football.

- June 2021: New York reports $1,858,642 of gross gaming revenue for June, the Empire State’s second-best month in 2021. However, this is still barely half of its January 2021 earnings. On the positive side, the Empire State has already generated more sports betting revenue in six months of 2021 than it did in all of 2020.

- May 2021: New York’s retail sportsbooks generate $1,590,114 in gross gaming revenue in May. To put this figure in perspective, New Hampshire generated $3,115,230 in the same time period. It seems even the New York Knicks making the NBA playoffs can’t help drive up the Empire State’s betting handle without online betting options. The coming launch of online sportsbooks will surely lead to exponential growth in New York sports betting revenue.

- April 2021: New York sportsbooks report $1,322,623 of gross gaming revenue for April.

- April 6, 2021: Governor Andrew Cuomo announces highlights of New York’s enacted budget for the fiscal year 2022, which authorized mobile sports betting in the state. The budget projections include $99 million in state revenue for the remainder of this year and more than $500 million in state revenue once mobile sports betting is fully phased in.

- March 2021: New York declared $1.8 million in sports betting revenue for the month of March.

- February 2021: New York raised $1,153,276 in gross sports betting revenue in February 2021 versus being roughly $180,000 in the red this time last year due to the onset of the COVID-19 pandemic.

- January 2021: New York sets a new state record in monthly sports betting revenue. Sportsbooks retained $3,569,855 after paying out winning bets. A new high of $356,986 in taxes wound up in state coffers. These figures will continue to grow if the state goes live with online betting in 2021.

NY Market Overview

To understand the sports betting market in New York, here’s some context.

State Population (2020 Census): 20,201,249

In-state Pro Teams: New York Yankees and New York Mets (MLB); New York Knicks and Brooklyn Nets (NBA); New York Liberty (WNBA); Buffalo Bills (NFL); New York Islanders, New York Rangers, and Buffalo Sabres (NHL). Several other teams represent NY but play in New Jersey.

Launch Dates: June 16, 2019 (retail), January 8, 2022 (online)

Biggest Monthly Revenue: $1,799,048,366 (January 2023)

Regulator: New York State Gaming Commission

Platforms: Online and retail

Tax Rate: 10 percent of retail-based revenue

New York Sports Betting Revenue Insights

New York is by far the most populated state that currently allows legal sports betting, and the NYC metro area is home to multiple teams from each of the big four sports leagues (NFL, NBA, MLB, and NHL). In theory, New York has the potential to be the biggest sports betting market in the country.

New York was quick to legalize sports wagering but was slow to authorize online betting. The state included online wagering in its budget for the fiscal year 2022 and will begin accepting applications for operating licenses in July 2021. Online sportsbooks launched January 8, 2022.

Here are some themes we’ve noticed when examining the New York market.

COVID Challenges

Casino closures due to the COVID-19 pandemic undoubtedly hindered the NY sports betting industry last year. On the bright side, this may have increased support for online betting options amongst state lawmakers as a way to capture much-needed revenue.

In 2020, New York sportsbooks reported a monthly loss for the first time, with revenue of -$179,593 in February. The industry stayed narrowly afloat in March 2020 before the state government was forced to shut casinos entirely for the next five months due to the spread of coronavirus.

Granted, few sports were happening in spring 2020, so the sports betting industry as a whole took a hit, and there were plenty of other more pressing concerns for citizens of New York. But with the state’s retail locations closed and no online betting allowed, once sports returned, New Yorkers’ only option was to travel across state lines to place their bets via a mobile app in New Jersey or Pennsylvania.

Missing Out

New York was missing out on millions of dollars in gambling revenue and state tax revenue every month by limiting sports bettors to in-person wagers even without coronavirus concerns.

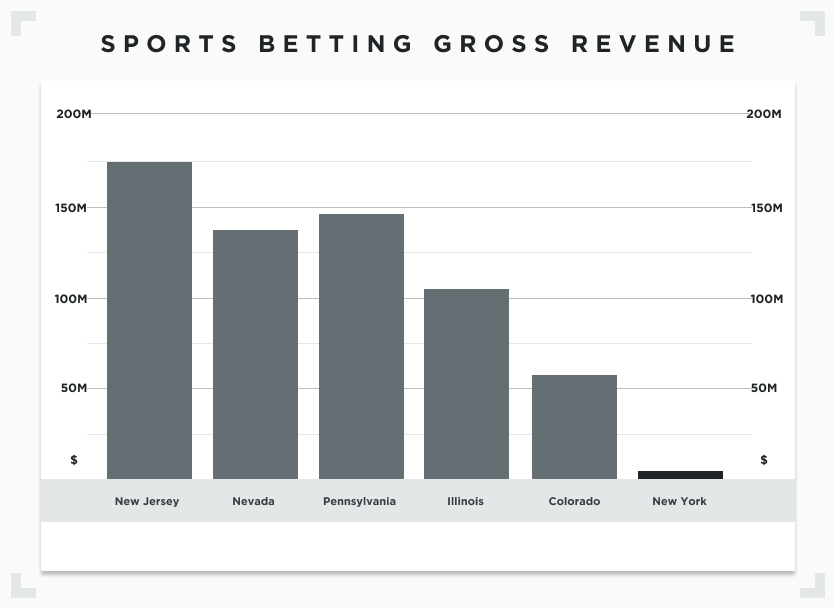

Here’s how New York sports betting gross revenue for the final three months of 2020 compares to that of the top US sports betting markets.

Perhaps even more illustrative of the benefits of allowing online wagers is a side-by-side comparison of New York and New Hampshire.

| New York | New Hampshire | |

|---|---|---|

| Allowed Online Betting in 2020? | No | Yes |

| State Population (2020) | 20,201,249 | 1,377,529 |

| In-State Pro Sports Teams | 9+ | 0 |

| Revenue (Oct-Dec 2020) | $7,501,911 | $13,511,987 |

Being slow to allow online and mobile betting held New York’s sports betting industry back.

In his bid to pass new sports betting legislation in 2021, Senator Joseph Addabbo Jr. cited a Spectrum Gaming Group report estimating that New York was missing out on approximately $1 billion per year in revenue without online sports betting.

Competitive Neighbors

New York should see a massive boost now that online sports wagering has launched, and this could perhaps one day be the nation’s biggest market. That said, it will likely always face stiff competition from other Northeastern states.

New Jersey was the largest market in America in 2020, and Pennsylvania has firmly secured itself in third place for the time being. Both sports betting powerhouses are neighbors to New York and have several well-known casino resorts. More importantly, their online sportsbooks were gifted several years to get a head start on building their customer base.

Nearby, Maryland looks set to launch sometime later in 2021, and other wealthy, sports-crazed border states such as Massachusetts are making moves towards legalization.

All of this to say, New York finds itself smack in the middle of a highly competitive corner of America when it comes to sports betting.

NY Sports Betting Apps

There are a number of sportsbooks in New York with top-rated betting apps contributing to the revenue. Here are the biggest players in NY:

Keep an Eye on the Empire State

New York is expected to catapult itself to the top of the US sports betting market.

Sports Betting Dime will keep you updated with the latest New York sports betting information, via our NY sports betting apps. To see how New York compares to other states, be sure to explore our state-by-state sports betting revenue tracker.