Bitcoin Bulls and Bears Face Off

By Aaron Gray in Entertainment

Updated: January 17, 2018 at 9:38 am ESTPublished:

It seems like everyone has an opinion on Bitcoin, and few people fall in the moderate middle of the spectrum. To some, it’s the “future of commerce;” to others, it’s the “biggest bubble in human history.” In a year defined by polarizing topics, Bitcoin might be the most polarizing of all.

Everyone from Mark Cuban to John Mcafee to Ghostface Killah has a strong opinion on Bitcoin. Below, we’ve juxtaposed the views of the most famous investors, economists, world leaders, and plain old celebrities to show just how split the globe is on Bitcoin. Whether you fall in the HODL camp (“hold on for dear life,” a favorite phrase of Bitcoin bulls) or the FUD camp (“fear uncertainty and doubt,” the preferred phrase of Bitcoin bears), having famous people square off about a contentious topic is always fun!

1. Ghostface Killah vs William Shatner

Want definitive proof we are living in a computer simulation? Both Ghostface Killah and William Shatner have strong takes on Bitcoin, and the Wu-Tang member is even a part of CREAM (Crypto Rules Everything Around Me) Capital.

Ghostface’s trademark cryptic lyricism lent itself well to grasping the complexities of cryptography, and after learning the fundamentals, Ghost marched his Wallabies over to CREAM capital. The company, whose name is a play on the classic Wu-Tang song C.R.E.A.M. (Cash Rules Everything Around Me), plans to offer 30 ATMs around New York City, in addition to its own token cryptocurrency, Cream Cash ($CASH), which will be tied to the US Dollar.

Brett Westbrook, the CEO of Cream Capital, detailed Ghostface’s role as “[an ambassador for] laying out a framework for which cryptocurrencies are more familiar to everyday people.” Using his penchant for storytelling, Ghost aspires to preach the benefits of Bitcoin and other cryptocurrencies. Ghostface Killah, decked out in vintage polo gear and borrowing iconography from sources as disparate as Iron Man and niche kung-fu films, is the embodiment of cool.

By contrast, William Shatner is the embodiment of a square: a man permanently lodged in the 1950s. Of course, there is certainly a kernel of truth in Shatner’s statements. For conservative types resistant to change, Bitcoin is not easy to acquire or store. But willingness to explore new technology aside, it’s fair to say that the guy who played a huge role in creating modern hip-hop might be a little more in-tune to the current zeitgeist than a man who’s endlessly parodied on Family Guy.

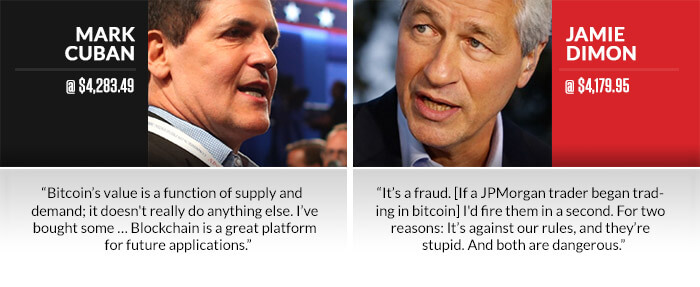

2. Mark Cuban vs Jamie Dimon

Jamie Dimon’s labelling of Bitcoin as a “fraud” is almost certainly the most-quoted line about Bitcoin to date. But that’s not because people are using it to auger Bitcoin’s demise, it’s because people love using it to make him look, to be blunt, stupid. Further statements from the JP Morgan CEO make it clear that he has no concept of where Bitcoin’s value comes from. Since his infamous quote, not only has Bitcoin increased in value over four times, but the company he oversees, JPMorgan Chase, has publicly stated that it intends to seriously consider offering its clients exposure to Bitcoin. Dimon might persist in his belief that those who buy Bitcoin are going to “pay the price” eventually, but those who have disregarded his advice have seen their net worth skyrocket.

In contrast, Mark Cuban has been quite bullish on Bitcoin and the blockchain technology that underlies it. The heavy-hitting celebrity investor has invested in numerous cryptocurrencies, and he’s likened it to regular non-dividend equity, driven almost exclusively by the basic tenets of supply and demand.

The difference of opinion on Bitcoin’s fundamentals between these two behemoths of the financial industry is essentially the debate that underscores the entire sector: does Bitcoin have any real value? Dimon doesn’t seem to think so, and Cuban believes it has enough to warrant more than a passing interest. Hopefully, Dimon doesn’t lose his job at JPMorgan and end up on Shark Tank. Things might get ugly.

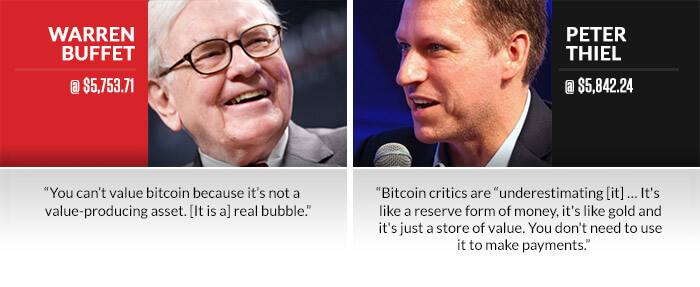

3. Warren Buffett vs Peter Thiel

Much of Bitcoin’s early promise was its potential to facilitate international transactions instantly, with record low fees. With a universally valued digital currency, bank holdings, settlement fees, conversion fees, and a whole host of cumbersome bureaucracy could fall by the wayside on the strong back of the blockchain’s revolutionary technology. Peter Thiel, a self-made billionaire, sought to achieve many of the same benefits when he started PayPal in 1999; it turns out the Blockchain might offer another solution to these problems, albeit one that emerged nine years later. Doubtless, this plays a massive role in Thiel’s appreciation of Bitcoin as an alternative store of value.

Warren Buffett, on the other hand, doesn’t see the same promise in Bitcoin. The most successful value investor in human history, Buffett doesn’t see any metric that suggests Bitcoin has any worth. By his definition, he’s right. But what Thiel and countless other HODLers preach is that traditional definitions of “value” and “assets” are antiquated. Much like the internet changed the definition of communication, Bitcoin has changed how we understand the value and nature of assets.

Maybe Buffett knows something Thiel doesn’t. That being said, Buffet passed on investing in Facebook and Google, and retains significant holdings in both coal and cigarette companies. There’s certainly more than a little evidence to suggest he might be on the wrong side of history in the 21st century.

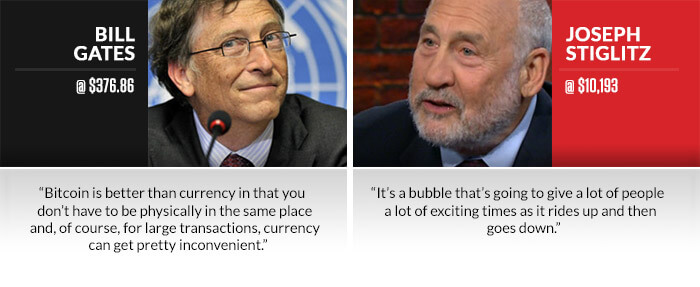

4. Bill Gates vs Joseph Stiglitz

Joseph Stiglitz, a professor of economics at Columbia who was named one of Time Magazine’s 100 most influential people in the world, views Bitcoin in a much different light than the world’s most famous technologist, Bill Gates. In many ways, this faceoff typifies the lack of agreement on Bitcoin between those who style themselves as futurists and those who represent the old guard in economics.

Gates has gone on record multiple times to express his belief in the transformative potential of Bitcoin and the blockchain; his company, Microsoft, was one of the first major businesses to accept Bitcoin, doing so when the virtual currency was still in its infancy in 2014. Given that Bitcoin payments make up a minuscule portion of Microsoft’s business, many read the decision to accept Bitcoin as merely a nod to the latent power of the cryptocurrency. But considering Gates has played such an instrumental role in the digitization of the entire globe, it’s little wonder that he lauds Bitcoin’s ability to make economics more efficient.

Stiglitz, the man who’s authored light fares like Globalization and Its Discontents, doesn’t see the merits of Bitcoin. In his eyes, Bitcoin doesn’t have any tangible societal utility, either on micro or macroeconomic levels. He doesn’t think that Bitcoin can function to solve any of the complex problems that beset nations across the globe. No one can doubt Stiglitz’s knowledge of international finance, however, this assertion is demonstrably false, as one has to look no further than Venezuela and large sections of western Africa to see how Bitcoin provides a means of exchange for citizens who can’t rely on their nations’ fiat currencies. There’s a chance that Bitcoin might be overvalued, but to regard it as a purely speculative instrument that should be outlawed seems tragically misguided, if not cruel.

5. John McAfee vs Tyler Moore

When it comes to talking Bitcoin, no one gets more invested in its survival than cybersecurity experts. Antivirus software magnate John Mcafee is so confident in its potential that he is literally willing to put his manhood on the line. However, there is still some disagreement as to whether the Bitcoin blockchain can be hacked.

An expert in all things cybersecurity, Mcafee regards blockchain technology as wholly resistant to malicious infringement. Nearly wiped out by the 2008 financial crisis, Mcafee has been living life on the lam from Brazilian authorities since he was accused of killing American expat Greg Faull in 2012 in Belize. Disillusioned after losing much of his fortune in the American economy, his libertarian, anti-government bent is so strong that he ran for president in the Libertarian party in 2016, finishing second to Gary Johnson; Bitcoin is the crux of what makes his particular brand of libertarianism both possible and palatable. After all, Bitcoin is decentralized, and no world government has yet devised any reliable way to regulate, tax, or track it. There are no bailouts in the world of Bitcoin. With a vital organ on the line, Mcafee obviously believes in Bitcoin as a secure long-term hedge against governments overstepping their boundaries.

Other cybersecurity professionals disagree with McAfee’s take. Tyler Moore, professor of cybersecurity at the University of Tulsa, doesn’t think that there is a code that hackers can’t crack, and since Bitcoin is nothing more than an elaborate computer science protocol, he isn’t sold that it’s invulnerable. With the near-limitless power of quantum computing on the horizon, Bitcoin might not be as safe as Mcafee’s willie might hope.

6. Julian Assange vs Ben Bernanke

Everyone’s favorite nihilistic agent of chaos, Julian Assange, is a big fan of Bitcoin. After releasing controversial US documents (or state secrets, depending on who you ask) provided to him by Chelsea Manning, PayPal, Mastercard, and a whole host of international payment networks froze Assange’s assets and banned him from using their systems. Assange needed to keep Wikileaks running, so he turned to the payment method controlled by no central authority, Bitcoin. His early adoption of the cryptocurrency has been tremendously rewarding; a 50,000% return is nothing to scoff at. Say what you will about Assange’s motives and goals, but the fact is that Bitcoin was tremendously effective at bypassing capital controls, allowing Assange to continue his subversive work.

Ben Bernanke, former head of the United States Federal Treasury, doesn’t share the same views as Assange. According to him, it’s only a matter of time until regulators get their paws on the Bitcoin blockchain. Currently, regulating Bitcoin is technically unrealizable, but if Bitcoin continues to grow in both value and transaction volume, you can bet that the US is going to invest some serious money into figuring out a solution to the blockchain’s anonymity.

Between all the referendums, special (and regular) elections, reinvigorated cold-warriors, and net-neutrality debates, 2017 could easily be titled “the age of fracture,” if not “the age of argument.” Divisiveness — political, social, and economic — is growing exponentially, with little indication of reaching a summit anytime soon. Its upward trajectory is eerily reminiscent of something else that’s dominated the 2017 news cycle: Bitcoin!

The world’s biggest cryptocurrency surged in value by over 1,600%, and is still climbing. Debates surrounding “the internet of money” are outgrowing siloed corners of the internet and Wall Street, and extending into mainstream culture. If you need a refresher on Bitcoin and what moves its price, check out our previous article on Bitcoin price predictions for 2018.

Sports & Politics Writer

Aaron has been featured in publications such as Intelligence Magazine, The Investing News Network, Haven, Tech Bullion, and many local and national publications. He has contributed to SBD since 2017. Western B.A. '14, NYU M.A. '17.