Will the Fed cut rates in January? See odds for Fed decision on prediction markets

By Paul Lebowitz in Politics News

Published:

- The Federal Reserve will meet in January to decide whether to cut interest rates; previous meetings saw a divide among officials regarding rate cuts

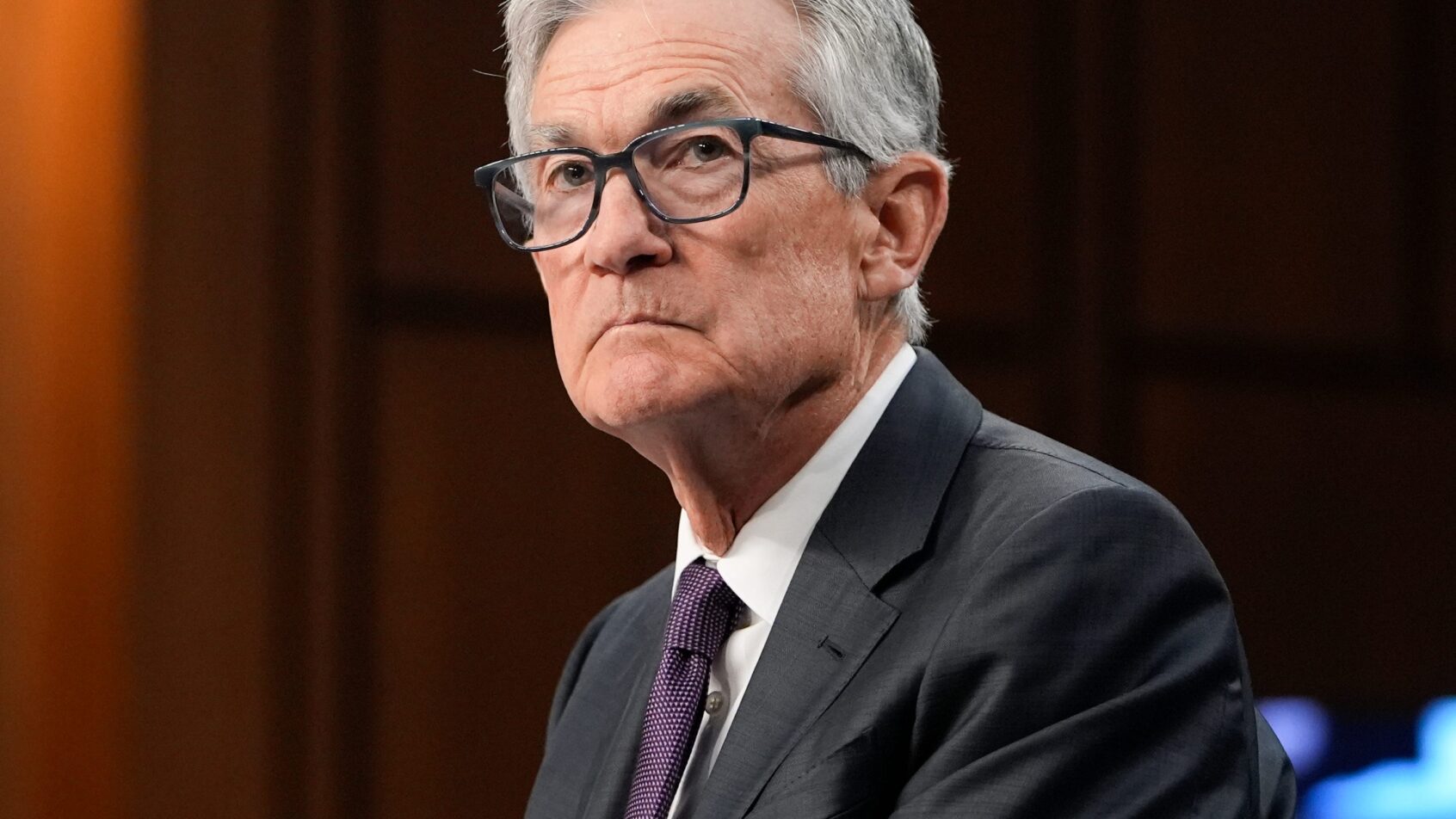

- Fed Chair Jerome Powell has been cautious, while President Trump has branded a more hard-charging stance

- See the latest prediction markets and odds for a Fed decision in January

When financial policymakers met at the Federal Open Market Committee (FOMO) on Dec. 9-10, it indicated that it believed cutting the interest rate would be beneficial if there was a decline in inflation. However, they were not on the same page when it came to when they would cut rates and how much it would be.

Philosophies clash regarding aggression and stability for monetary policy

Despite Powell’s term as Fed chair expiring in May and the President making clear he wants Powell out as soon as possible, the chairman remains influential. He prefers stable rates to counteract inflation. Trump wants rate cuts to encourage borrowing.

Judging by the minutes from the December meeting, it’s expected that the rates will remain the same when they meet at the end of January. Those in favor of lowering the rate indicated a willingness to leave the rate as is. Nine of 12 officials voted to reduce the benchmark interest rate for the third consecutive time, with the range being from 3.5% to 3.75%.

When looking at the 2025 projections, six officials were opposed to a rate reduction, preferring the benchmark rate to stay at 3.75% to 4% by the end of the year.

Prediction markets are weighing whether there will be a rate cut or if the Fed will instead maintain the status quo. Given the current market indications, the result is heavily tilted towards the latter.

Odds for the January Fed decision on rates

New users on Kalshi can claim a $10 Sign Up Bonus once they have completed at least $100 in trades.

The current odds for the Fed maintaining its rate are at nearly 90%. For a cut, they have it at around 10% for 25bps (basis points reduction). Greater than 25bps is at 2%. There are no options for 2bps or more.

For those considering whether to jump into the prediction markets, the market will resolve to “Yes” if the Fed does not raise rates by Jan. 28, 2026. The Federal Reserve will be the verifying entity for this outcome.

This is not a mutually exclusive market, meaning more than one tradeable outcome can be correct. If the Fed keeps rates at the status quo, those who staked the “Yes” outcome for ‘Fed maintains rate’ will be correct. Users who purchased event contracts for the “No” outcome of ‘Cut 25bps’ would also be correct in this hypothetical scenario.

The Kalshi referral code is the best way to sign up and trade on a Fed decision in January 2026, as it will provide a profitable welcome bonus for new users.

Could the Fed pull a surprise and cut rates again?

All indications are that the Fed will maintain its rate at the January meeting. Still, the wild card is and will always be President Trump.

The President continues his verbal assault on Powell, with the most recent remarks at his year-end meeting with Israeli Prime Minister Benjamin Netanyahu at Mar-a-Lago. Trump again said he wants to fire Powell, but with the Fed Chair’s term nearing its end, he will not pursue the matter.

Even after three rate cuts in 2025, Trump wanted a higher cut at the December meeting. The President is adroit at exerting pressure, both overt and subtle. Announcing the new Fed Chairman at around the same time the January meeting takes place will suit Trump’s need for both showmanship and to serve as a clear indicator of what he wants, as if it wasn’t already clear. That means another rate cut.

Powell is risk-averse. Trump wants to stimulate the economy by making it cheaper to borrow, so that people will spend.

This has proven to be an unbridgeable philosophical divide between Trump and Powell. The next Fed Chair will likely be someone who shares Trump’s aggressive vision.

As the midterms approach, Trump will want a boosted economy to show that his economic vision is working. Keeping as many allies in Congress as possible would, from his perspective, benefit the country as a whole. This is particularly true in a fraught landscape and questions about Trump’s strategy with Israel, Gaza, Russia, Ukraine, and across the globe.

When trading on financial prediction markets, it is wise to understand the available options. Each has various attributes that will suit the needs of all users. Being vigilant goes beyond understanding the market, but also knowing where to trade. Research is key.

Paul Lebowitz is a novelist, columnist, social commentator, and the author of eight published books on baseball – one novel and seven baseball guide/previews. He covers sports, politics, and pop culture. Paul graduated from Hunter College with a degree in English. He lives in New York City.