Nevada is unrivaled in its gambling history in America, but it is no longer the top US sports betting market.

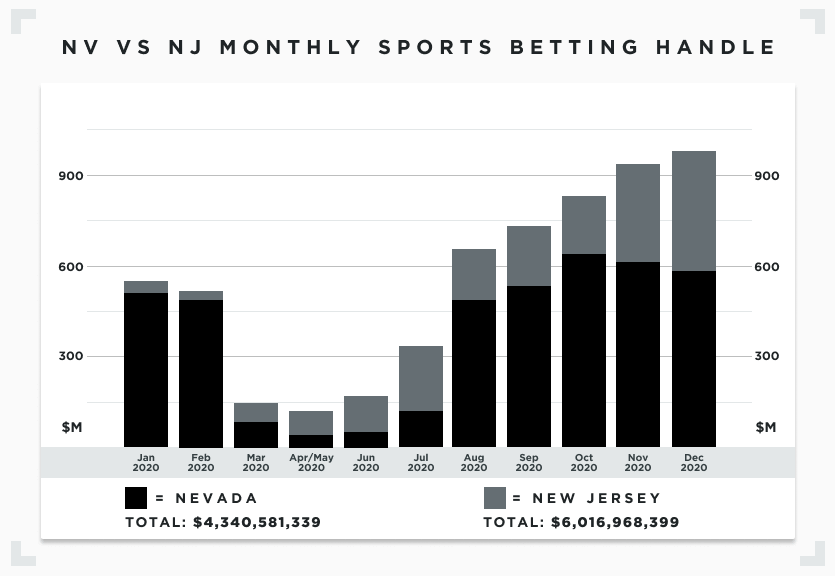

New Jersey finished 2020 with by far the highest annual sports betting handle of any state, surpassing hard-hit Nevada by more than $1.5 billion in wagers placed. Will NJ stay ahead in 2021, or will Vegas come roaring back as the COVID-19 pandemic recedes?

We’ll keep you informed with the latest financial figures and analysis of monthly Nevada sports betting revenue reports. Below you can also scroll back in time to see the growth of sports betting in the Silver State since the Professional and Amateur Sports Protection Act’s repeal in 2018, which ushered in a new era for the industry.

Read on for an in-depth look at the business of sports betting in Nevada.

Nevada Sports Betting Revenue: Month-by-Month

Sports Betting Dime continually monitors the growth of legal sports wagering in America by tallying monthly revenue reports from each state.

For clarity, here’s what each number represents:

- Handle refers to the total amount wagered on sports.

- Revenue reflects the gross gaming revenue kept by sportsbooks after paying out winning bets.

- Hold percentage shows how much revenue sportsbooks kept as a function of the betting handle.

- State tax revenue displays taxes collected by the state and local jurisdictions.

The table below shows the Nevada sports betting industry’s key financial figures every month from the repeal of PASPA in June 2018 to date.

| Month/Year | Total Handle | Revenue | Hold Percentage | State Tax Revenue |

|---|---|---|---|---|

| June 2018 | $286,548,295 | $20,173,000 | 7.04% | $1,361,678 |

| July 2018 | $244,638,554 | $4,061,000 | 1.66% | $274,118 |

| August 2018 | $247,622,790 | $12,604,000 | 5.09% | $850,770 |

| September 2018 | $571,034,483 | $56,304,000 | 9.86% | $3,800,520 |

| October 2018 | $528,568,873 | $29,547,000 | 5.59% | $1,994,423 |

| November 2018 | $581,070,664 | $27,136,000 | 4.67% | $1,831,680 |

| December 2018 | $561,859,873 | $44,106,000 | 7.85% | $2,977,155 |

| January 2019 | $497,482,993 | $14,626,000 | 2.94% | $987,255 |

| February 2019 | $458,591,549 | $35,816,000 | 7.81% | $2,417,580 |

| March 2019 | $596,752,294 | $32,523,000 | 5.45% | $2,195,303 |

| April 2019 | $328,121,212 | $21,656,000 | 6.60% | $1,461,780 |

| May 2019 | $317,380,282 | $11,267,000 | 3.55% | $760,523 |

| June 2019 | $322,077,670 | $16,587,000 | 5.15% | $1,119,623 |

| July 2019 | $235,659,955 | $10,534,000 | 4.47% | $711,045 |

| August 2019 | $287,757,296 | $18,733,000 | 6.51% | $1,264,478 |

| September 2019 | $546,358,867 | $52,068,000 | 9.53% | $3,514,590 |

| October 2019 | $543,552,781 | $47,887,000 | 8.81% | $3,232,373 |

| November 2019 | $614,118,812 | $31,013,000 | 5.05% | $2,093,378 |

| December 2019 | $571,179,245 | $36,327,000 | 6.36% | $2,452,073 |

| January 2020 | $502,543,641 | $20,152,000 | 4.01% | $1,360,260 |

| February 2020 | $489,105,725 | $38,064,000 | 7.78% | $2,569,320 |

| March 2020 | $141,108,201 | $1,455,000 | 1.03% | $98,213 |

| April-May 2020 | $56,263,737 | $2,669,000 | 4.74% | $180,158 |

| June 2020 | $78,152,387 | ($483,000) | -0.62% | $0 |

| July 2020 | $165,552,030 | $6,295,000 | 3.80% | $424,913 |

| August 2020 | $474,948,414 | $16,985,000 | 3.58% | $1,146,488 |

| September 2020 | $575,144,025 | $32,895,000 | 5.72% | $2,220,413 |

| October 2020 | $659,899,331 | $42,388,000 | 6.42% | $2,861,190 |

| November 2020 | $609,376,849 | $61,807,000 | 10.14% | $4,171,973 |

| December 2020 | $588,486,999 | $41,113,000 | 6.99% | $2,775,128 |

| January 2021 | $646,491,632 | $52,381,000 | 8.10% | $3,535,718 |

| February 2021 | $554,058,173 | $31,846,000 | 5.75% | $2,149,605 |

| March 2021 | $640,984,932 | $39,346,000 | 6.14% | $2,655,855 |

| April 2021 | $454,734,387 | $27,240,000 | 5.99% | $1,838,700 |

| May 2021 | $477,191,062 | $27,079,000 | 5.67% | $1,827,833 |

| June 2021 | $544,806,558 | $29,186,000 | 5.36% | $1,970,055 |

| July 2021 | $409,659,756 | $33,278,000 | 8.12% | $2,246,265 |

| August 2021 | $427,425,369 | $14,342,000 | 3.36% | $968,085 |

| September 2021 | $786,508,562 | $54,205,000 | 6.89% | $3,658,838 |

| October 2021 | $1,100,712,575 | $48,312,000 | 4.39% | $3,261,060 |

| November 2021 | $1,086,010,454 | $71,971,000 | 6.63% | $4,858,043 |

| December 2021 | $1,104,986,618 | $15,960,000 | 1.57% | $1,077,300 |

| January 2022 | $1,109,329,327 | $49,997,000 | 4.51% | $3,374,798 |

| February 2022 | $780,768,853 | $30,920,000 | 3.96% | $2,087,100 |

| March 2022 | $863,283,921 | $36,926,000 | 4.28% | $2,492,505 |

| April 2022 | $582,529,725 | $25,368,000 | 4.35% | $1,712,340 |

| Total (since launch) | $24,160,439,731 | $1,374,665,000 | 5.69% | $92,789,888 |

We’ll update the table above with the latest figures from the Nevada Gaming Control Board.

NV Sports Betting Revenue: Annual Figures

First, let’s take a look at the industry’s annual totals in Nevada since the overturn of PASPA in 2018. The table below shows Nevada’s annual sports betting handle, gambling revenue, and hold percentage, as well as state tax revenue collected.

| Year | Total Handle | Revenue | Hold Percentage | State Tax Revenue |

|---|---|---|---|---|

| 2018 | $3,021,343,532 | $193,931,000 | 6.42% | $13,090,344 |

| 2019 | $5,319,032,956 | $329,037,000 | 6.19% | $22,210,001 |

| 2020 | $4,340,581,339 | $263,340,000 | 6.07% | $17,808,056 |

| 2021 | $8,233,570,078 | $445,146,000 | 5.4% | $30,014,744 |

In what was a record year for the US sports betting industry as a whole, Nevada experienced a 20 percent drop off in sports betting revenue year-over-year from 2019 to 2020. The decrease reflects the toll of the COVID-19 pandemic on the Nevada tourism and gambling industries.

Latest Nevada Revenue News

Sports Betting Dime follows all the latest updates as the US sports betting market continues its explosive growth. Check this page to stay up to date with the most recent Nevada sports betting revenue news.

April 2022 – Nevada sports betting handle dipped dramatically in April 2022, coming in at $582,529,725. This is the lowest figure since August 2021.

March 2022 – Despite seeing another dip in monthly sports betting handle, Nevada sports betting revenue increased through March 2022. Nevada collected nearly half a million more in state tax revenue from sports wagering.

February 2022 – Nevada sports betting handle dipped below the $1 billion mark for the first time in five months despite the biggest sports betting event of the year, the NFL Super Bowl, landing on February 13. Nevada sports betting revenue remained strong, as sportsbooks collected over $30 million in revenue.

January 2022 – Nevada collected over $1 billion in total sports wagers for a fourth-straight month, and sportsbooks realized $49,997,000 in revenue from an improved 4.51% hold rate. The state saw $3,374,798 in tax revenue through January 2022.

December 2021 – Nevada rounded out the year with another monthly sports betting handle record, collecting a grand total of $1,104,986,618 in total wagers. Nevada has now collected over $20 billion in legal sports bets since June 2018.

November 2021 – Another month, another $1 billion in sports betting handle for Nevada. The Silver State set a record for revenue through one month, with sportsbooks collecting $71,971,000 off a 6.63% hold rate. State tax revenue also reached a new record at $4,858,043 in November.

October 2021 – Nevada became the second state in the country to pass $1 billion in monthly sports betting handle. The $1.1 billion total is the second highest on record after New Jersey, which collected $1.3 billion through October 2021.

September 2021 – The monthly sports betting handle in Nevada crossed the $700 million mark for the first time in September 2021, setting a state record.

August 2021 – After seeing a big dip in monthly handle through July, Nevada started to pick things up again with a $427,425,369 total figure in August. Don’t be surprised to see this number spike again in September as the NFL season gets underway.

July 2021 – July was a slow month for sports betting in Nevada. The monthly betting handle was just under $410 million, a 14 percent drop from July 2020. However, sportsbooks kept over 8 percent of handle ($33 million) after paying out winning bets, a solid month in terms of gross revenue. July also saw the Silver State surpass a major milestone: Nevada has cleared over $1 billion in sportsbook revenue since the overturn of PASPA in June 2018. Baseball was by far the most popular sport to bet on in July with $228 million wagered.

June 2021 – Nevada takes in just under $545 million in sports bets during June. The Silver State’s gambling industry is on the rebound thanks to increased tourism, as evidenced by the increasing percentage of in-person wagers. Nevada’s betting handle is up 14 percent from May while gross revenue increased by 8 percent. Baseball led the charge with $226 million in handle while basketball took in $194 million. Hockey was again a distant third ($44 million) despite nearly a full month of local action on the Vegas Golden Knights, who reached the semi-finals of the Stanley Cup Playoffs.

May 2021 – Nevada reports $477 million wagered on sports in May. The Silver State’s total betting handle since the overturn of PASPA in 2018 to over $15 billion. The only other state to surpass this milestone thus far is New Jersey.

Basketball was the most popular sport to bet on in May, with $181 million wagered on hoops. Baseball was a close second at just under $177 million. The success of the Vegas Golden Knights in the NHL playoffs gave hockey betting a boost. However, it was still a distant third with a betting handle of $52 million, an increase of about $6 million from April.

April 2021 – Nevada reports a betting handle of $454 million in April, its lowest since August 2020. However, it is still well on track for its best year yet. At its current pace, Nevada will easily surpass $6 billion in sports wagers for 2021. That said, there’s a risk of NV falling from its second-place position nationally to either IL or PA.

March 2021 – Nevada posts its third-highest month with $640 million handled, the fourth time the Silver State has surpassed the $600 million mark. Through three months of 2021, Nevada is well on pace to exceed its annual record of $5.3 billion set back in 2019.

Nevada Market Overview

Before we analyze all those numbers, let’s start with some key details to set the scene for sports betting in Nevada.

State Population (2020 Census): 3,104,614

In-state Pro Teams: Las Vegas Raiders (NFL), Vegas Golden Knights (NHL), Las Vegas Aces (WNBA)

Launch Date: 1949

Biggest Monthly Handle: $1,104,986,618 (December 2021)

Regulator: Nevada Gaming Control Board

Platforms: Online and retail

Tax Rate: 6.75 percent

Nevada Sports Betting Revenue Trends

Once the only place you could bet on sports in America, Nevada enjoyed a decades-long head start on other states. The Vegas sports betting scene is globally famous as being one of the best places to follow the action in person.

That said, in terms of generating sports betting volume, Nevada lost its top spot to New Jersey in 2020. Let’s explore what happened and explain why Nevada will still be a powerhouse sports betting destination for years to come.

COVID Challenges

It’s no secret that Vegas was hit hard in 2020 by casino closures and travel restrictions during the COVID-19 pandemic. Looking at monthly betting handles shows that Nevada sports betting revenue took a steep drop last spring.

Casino closures and suspended sports leagues affected the American sports betting industry across the country, but international tourism’s shutdown likely hurt Vegas the most.

Here’s a side-by-side comparison of 2020 betting volumes in Nevada and New Jersey.

The above graph shows that the New Jersey sports betting industry weathered the COVID storm far better than Nevada did. The Garden State was consistently the top sports betting market in the United States all year, thanks largely its robust online sportsbooks.

As of February 2021, Nevada recorded six straight months of $500 million or more in betting handle, a strong signal that its sports betting industry is alive and well. Vaccines and a resurgence of travel and tourism should help Vegas continue its rebound and take sports betting to new heights in 2021.

Room for Improvement

Nevada embraced the gambling industry long before other jurisdictions. Essentially an adult playground, the Las Vegas Strip is an international destination because of its casinos and entertainment. Tourism and progressive gambling policies inject billions into the Nevada economy every year.

One area where the Nevada sports betting industry could improve? It hasn’t embraced online betting to the fullest extent.

The Silver State still requires bettors to register for their online sportsbook accounts in person. Online sports bettors must make their first deposit at the app’s partner casino. Perhaps the casinos prefer it this way, but the extra hoops online bettors need to jump through to get started undoubtedly impact new customer acquisition and make it harder to attract casual sports fans into the action. As the financial reports suggest, this restrictive regulation is particularly devastating in a pandemic.

Nevada is without a doubt a sports betting powerhouse, particularly for a state with a population of just 3.14 million people, but there’s room for improvement.

Learn More About Sports Wagering in Nevada and Beyond

Nevada is the epicenter of the American gambling industry, but it’s been surpassed by New Jersey in terms of sports betting. Can the Silver State take back its top spot, or will it settle for second place?

Online betting has proven to be the most convenient form of wagering, but don’t be surprised if bettors flock back to Vegas and other retail sportsbooks in Nevada in 2021 and beyond.

Sports Betting Dime will keep you up to date with the latest NV sports betting via our Nevada state page, as the market continues to evolve. To see how NV compares to other markets, be sure to check out our state-by-state sports betting revenue tracker.

Have fun and enjoy the action out there!