Event Trading: Best Apps & Sites for July 2025

By Kevin Wolff

Updated:

Verified by: Patrick Cwiklinski

Best Event Trading Platforms

As the landscape provides in 2025, there are several platforms available for users to legally trade event contracts. These trading platforms are all federally regulated, ensuring safe and trusted investing marketplaces for investors to stake yes/no positions on a variety of real-life outcomes.

Some of the popular platform options for trading on event outcomes include Kalshi, the Chicago Mercantile Exchange (CME), and Crypto.com. To fund the marketplace these platforms collect fees on most trades, this also allows them to operate with full federal regulation.

Kalshi

NOTE: Kalshi is currently unavailable in Illinois, Maryland, Montana, New Jersey, Nevada, and Ohio.

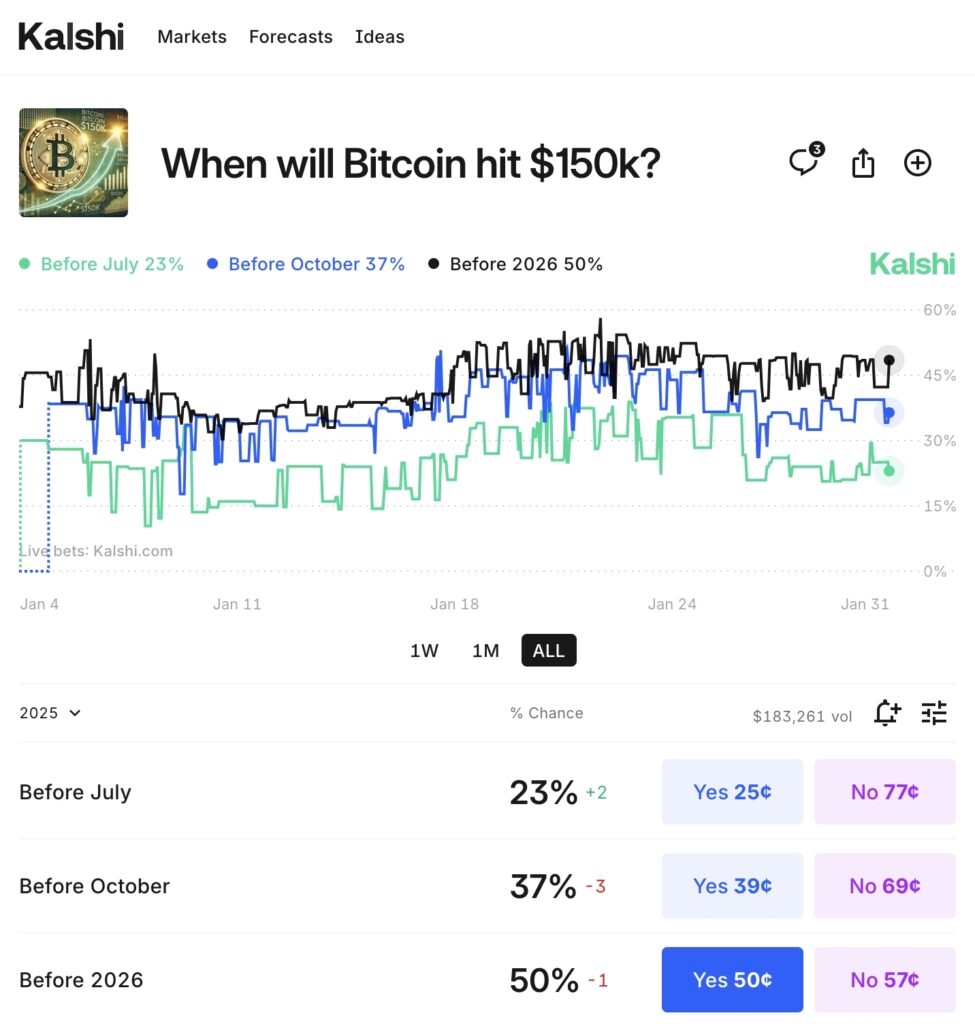

Kalshi was founded in 2018 and later launched in July 2021 offering event contract trading for users in 44 states. Available event contract categories on Kalshi include Politics, Sports, Culture, Crypto, Climate, Economics, Companies, Financials, Tech & Science, Health, World, and Transportation. Kalshi is regulated by the Commodity Futures Trading Commission (CFTC) and has secured major investors like Sequoia Capital, Charles Schwab, and Y Combinator, among others. Kalshi was offering NFL prediction markets for the Super Bowl, allowing bettors in states where online sports betting is not legal, to try trading sports contracts instead.

It was also a major player in trading on the presidential election, something the sports betting industry in the US does not allow.

Chicago Mercantile Exchange (CME)

The Chicago Mercantile Exchange (CME) is another federally regulated event contracts trading platform that has been providing the ability to trade on events since 2022. While the CME options of categories/fields for different trading events are not quite as broad as some other platforms, there is still ample ability to make trades on event contracts like the predicted closing price of cryptocurrencies like Bitcoin, as well as other commodities and indexes.

Crypto.com – Sports Event Trading

Crypto.com offers trading capabilities on sports events for investors in all 50 states. Tradeable sports event contracts are available for users on the Crypto.com App as well as those on the Crypto.com website. Users are given the option to stake a yes/no position on a sports event contract based on what they believe the outcome of the sporting event will be.

After the conclusion of the sports event in question, users who have staked the correct side of the outcome will receive a $100 (USD) payment for each contract they own. Investors who purchased contracts for the losing side of the yes/no outcome will lose only the amount they paid to open the position.

Event Trading: Explaining Event Contracts

If you’ve only ever dealt with traditional sportsbooks, trading event contracts might sound intimidating, but it’s actually a very easy concept to understand. Users trade on yes/no contracts that represent the outcomes of specific events, these are called event contracts. Investors select the yes/no side (position) of the contract they wish to take and can choose how many contracts they purchase at a given price. Then, the event occurs and one of the sides is proven to be correct. Investors who hold the proven correct side of the yes/no outcome will keep the profit (total value) of the contracts.

There is a fundamental difference between event contracts and traditional futures contracts as it pertains to investing. Traditional futures contracts are priced based on the expected prices of commodities and financial instruments. Event contracts are priced based on the probability of a particular event outcome (yes/no) winning or losing.

Another important difference to point out is that event contracts are not beholden to pre-determined calendar dates or market closings. Rather, the event in question is the determining factor. When it plays out in a yes/no outcome, the event contracts are graded accordingly. Event contract trading is a very user-friendly way to invest, as there is a capped risk with these trades. Event contracts expire once the event has occurred, so the maximum risk is the initial premium paid for the contract.

How to Trade Event Contracts

Trading event contracts is a simple process, and there are several federally regulated trading platforms available for prospective users. Both the Kalshi platform and Chicago Mercantile Exchange (CME) provide a variety of event contract trading markets, and Crypto.com has impressive sports event trading options.

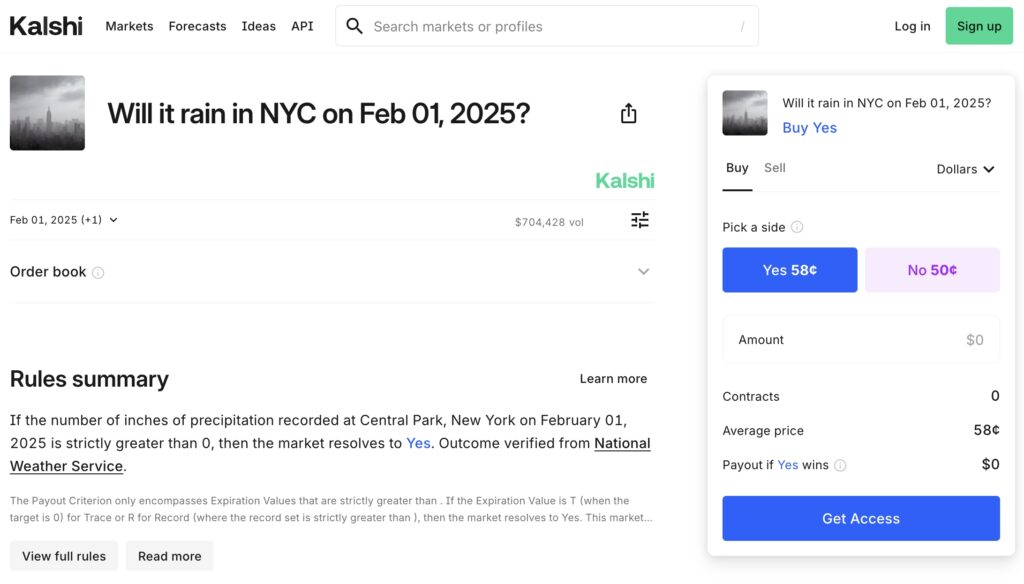

To give an example of how to trade event contracts, a trading platform may have an event contract for something like “will it snow today in New York City?” The prices of the yes/no event contracts for this question will be reflective of the probability of the snowfall occurring, and the contract prices will change based on how the investing public stakes either side of the contract. Then, if it snows in NYC, those who purchased “Yes” event contracts will keep the profit (total value) of the contract, while those who purchased “No” event contracts will not keep anything. The roles would be reversed if there was no snowfall in NYC during the window of time for the event contract in question.

When trading event contracts, users also have the option to sell their position before the event in question is determined. This can yield profit based on how the market has shifted since the contracts were initially purchased, dictated by the market’s action on yes/no contracts being traded for that event.

Event Contract Trading Markets

Part of what makes trading event contracts so attractive is the variety of available markets. Events range across a wide range of categories for users to trade on including weather, economics, cultural events, financial markets, politics, sports, technology, and more.

Below are some of the most interesting event contract trading markets you can access right now.

Politics

Political outcomes are among the most popular fields to buy and sell event contracts. Political event contracts can offer many different options, like trading on the result of a federal or state election, a certain bill to pass, a cabinet appointment, senate confirmation, a Supreme Court case ruling, and many others.

Financial Markets

Trading financial market event contracts is available on several platforms and allows users to stake positions on outcomes like the closing price of the Nasdaq or S&P on a given day, the price of WTI oil on a given day, the price of a currency pair, such as EUR/USD or USD/JPY, treasury daily yields, and many other options.

Weather

Weather outcomes offer a variety of event contracts for markets spanning all across the globe. Examples of tradeable weather event contracts could be whether it rains or snows in a certain location on a specific day, a certain city to reach a temperature threshold on a given day, or the occurrence of natural disasters like tornadoes, hurricanes, earthquakes, and others.

Economics

There are event contracts available for users to trade on real-world economic outcomes like a potential debt default, inflation levels, a recession, prices of common goods, unemployment rates, fed rate cuts, job numbers, GDP growth, CPI, and other popular options.

Health

Trading world health event contracts is also an option, with contracts for vaccine/drug approvals (or losing approvals), the number of prescriptions for a certain drug, the breakout of a pandemic, public health emergency declarations, and many more.

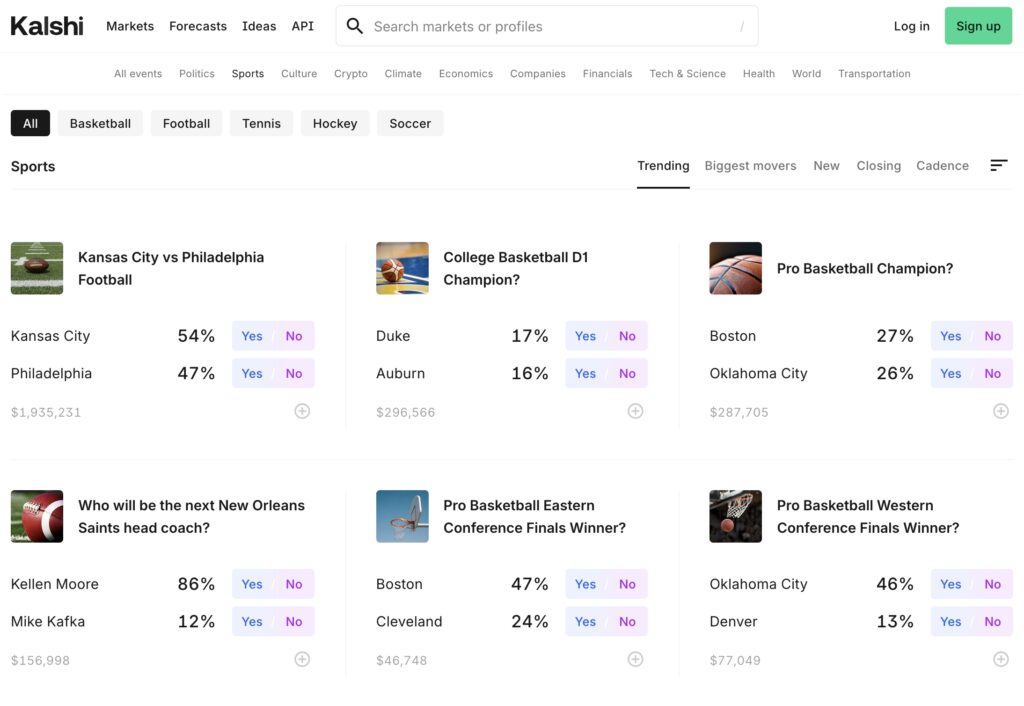

Sports Event Trading

Sports event trading has become increasingly popular in recent times. While legal sports betting via commercial sportsbook platforms like DraftKings and FanDuel is not currently live in all 50 states, the ability to trade sports event contracts is available nationwide. Sports event contracts range from professional to collegiate levels in a variety of popular sports like football, basketball, baseball, hockey, and soccer to name a few.

Given that most sports events end with a winner and a loser (excluding ties) there is an obvious answer to yes/no outcomes on tradeable sports event contracts. These sports trading contracts can be for outcomes like the winner of a specific game, the winner of a conference, or even a team to run through the playoffs and win a championship.

US users have the ability to increase, decrease, or close their positions (holdings) on sports event contracts before the event takes place. The difference between the contract price when it was initially purchased vs. the price when it’s officially closed will result in a profit or loss (excluding fees), depending on the movement of the market in the given period of time.

Those who purchased contracts for the correct outcome of the sports event will receive the full value of the contract (profit) at the conclusion of the event in question. Those who purchased event contracts for the wrong side of the event outcome will receive $0.

Regulated platforms like Kalshi and Crypto.com offer sports event contract trading for users throughout the country.

Event Trading Legal States

Event trading is legal and available in all 50 states nationwide. The ability to legally trade event contracts on federally regulated platforms is very convenient, particularly when examined through the lens of a field like sports trading. Traditional sports betting is not legal in all 50 states, whereas the ability to legally trade sports event contracts is offered nationwide.

The continuous growth of financial gamification across many different topics and industries stands as reason to believe trading sports prediction markets will likely continue to increase in popularity. Investors in all 50 states can trade on a variety of event contracts spanning across a plethora of real-world outcomes.

Event Contract Trading Regulation

Event contract trading and the subsequent platforms/marketplaces operate under the regulatory eye of the Commodity Futures Trading Commission (CFTC). Part of the CFTC’s responsibilities as it pertains to regulating event contract trading include:

- Prohibiting event contracts that are unlawful or contrary to the public interest

- Investigating violations of the CEA and the CFTC Regulations

- Regulating security futures products (SFPs) with the Securities and Exchange Commission (SEC)

Event Trading FAQ

Some of the popular queries pertaining to the topic of trading event contracts.

Event contracts are available for real-world outcomes across a variety of options including financial markets, politics, weather, sports, economics, health, and more.

As per CFTC regulations, the minimum age for all futures trading, including event contracts, is 18 years old.

The Commodity Futures Trading Commission (CFTC) regulates all event contract trading in the United States.

Yes, users can download the Kalshi app as well as the Crypto.com app to trade event contracts from the convenience of a mobile device.

Event contract trading is legal and available in all 50 states nationwide.

Sports event trading markets are growing, but you can currently find futures markets for the NFL, NBA, WNBA, March Madness, MLB, NHL, Champions League and much more.

After years of writing as well as Data Analyst work for Pro Football Focus, Kevin Wolff is now a Sports Betting Writer for SportRadar, and more specifically, SBD. A graduate of Fordham University in NYC, Kevin is also a full-time dog dad when he's not writing.