Kalshi Promo Code DIME for $10 Sign-Up Bonus for July 2025

By Kevin Wolff

Updated:

Verified by: Patrick Cwiklinski

NOTE: Kalshi is currently unavailable in Illinois, Maryland, Montana, New Jersey, and Ohio.

Kalshi Event Trading is the world’s first federally regulated exchange platform for trading on real-world events. Founded in 2018, Kalshi was officially launched in July 2021 and now allows investors to trade directly on the anticipated outcome of future events like financial markets, politics, weather, sports, and more. The Kalshi platform is regulated by the Commodity Futures Trading Commission (CFTC) and backed by major investors like Sequoia Capital, Y Combinator, and Charles Schwab, to name a few.

If you’re looking to trade on popular events such as the Super Bowl, presidential elections, or the Oscars and Grammys, new users can now claim Kalshi promo code DIME for a $10 sign-up bonus. This a great opportunity for sports fans looking for a sportsbook alternative as well as other people who are looking for action on other big pop culture events.

Kalshi Promo Code for New Users

How To Sign Up With Kalshi

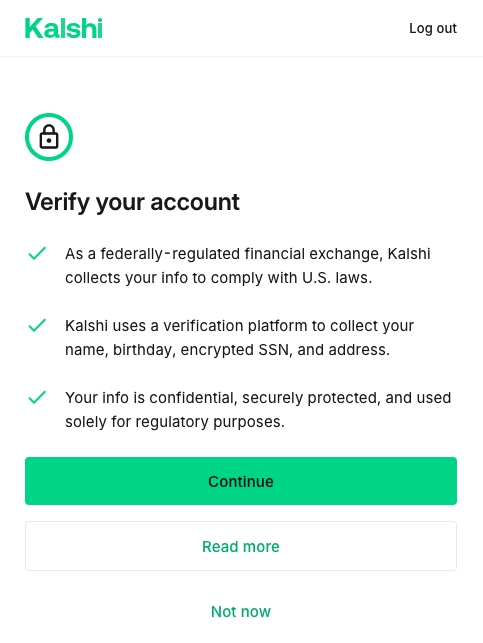

Registering for an account on Kalshi is very easy to do, and there are just a few requirements that users must meet. To create an account on Kalshi, users will need to enter the following information to verify their identity, including:

- Date of birth

- Phone number (and confirm the verification code sent to that number)

- Social Security Number

- Residential address

When the user has confirmed all their account details and is officially registered, they will next need to deposit funds into their account.

Kalshi Available States

Kalshi is available in 44 states throughout the country, offering great coverage for prospective users. The nationwide accessibility to trade on major events is a very attractive aspect of the Kalshi platform, particularly when highlighting specific event trading categories, like sports. Sports betting is not yet available nationwide, but users in 44 states can trade sports event contracts on Kalshi. The Kalshi Event Trading platform is available in a website setting, and users can also download the app on both iOS (Apple) and Android (Google Play) devices.

Kalshi Event Trading: How It Works

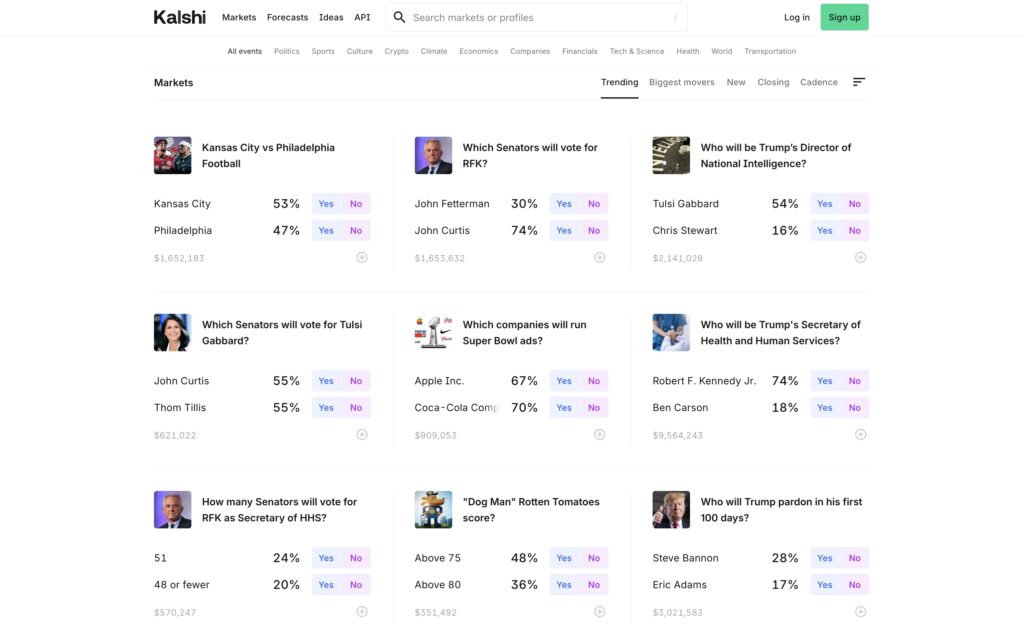

The Kalshi platform allows investors to trade on a variety of future event outcomes in 44 states throughout the country. With Kalshi Event Trading, users can buy and sell Event Contracts on a regulated exchange and prediction market. Kalshi offers the ability to trade Event Contracts across various fields including culture, economics, weather, scientific advancements, sports, financial markets, and more.

Trading contracts on Kalshi is very simple. To start, users pick an outcome (side and price) for a yes-or-no question that represents the probability of a specific future event. When the opposing sides total $1 per contract, a trade occurs. Then, the event plays out, and the side that is proven correct keeps the full $1 for the contract. Kalshi collects revenue through transaction fees on each trade, allowing the prediction market platform to be fully regulated.

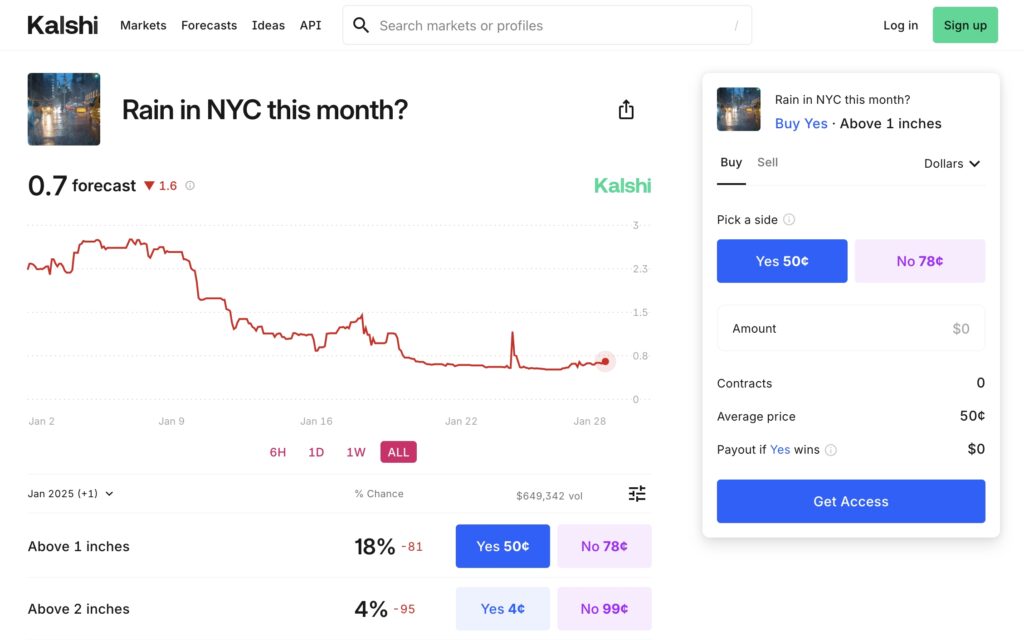

Kalshi Event Trading uses event contracts as the unit of commerce, with each contract representing a yes/no question about a future event. For example, “Will it rain today in NYC?” The price of each contract on the Kalshi platform reflects the probability of the event occurring, and contract prices will fluctuate based on the market’s perception of the event outcome. If the event occurs as the user predicted, the contract will pay out $1. If the event in question does not occur as predicted, the contract will pay out $0.

Kalshi offers several ways for users to trade contracts, including Quick Orders, Sell Orders, Limit Orders, and Limit Sell Orders. Each order is an individual request to buy or sell an event contract on Kalshi. Quick Orders and Sell Orders are immediate, so they’re very user-friendly for new traders. Limit Orders provide users with more precise ability including the timing and price of each trade. Quick Orders and Sell Orders are subject to fees, while Limit Orders and Limit Sell Orders only charge fees on trades that execute immediately.

Quick Order

The easiest way for users to purchase event contracts on Kalshi is with Quick Orders. A Quick Order allows a user to immediately buy a specific amount of event contracts at the best available prices. To execute a Quick Order, users pick the yes/no side of the event contract in question, specify the amount of contracts they want to purchase, and the Kalshi platform will immediately buy all the cheapest contracts available for that user.

Depending on the size of the order, there is a chance that not all the contracts purchased will be the same price. This is simply because there may only be a certain number of contracts available at that price, but rest assured that Quick Orders will always immediately purchase the cheapest available event contracts.

Sell Order

A Sell Order is the easiest way for users to sell event contracts they already own on Kalshi. Sell Orders are immediately executed at the best available price, essentially the inverse of a Quick Order, or a buy order for the opposite outcome of the contract. All Kalshi Event Trading is based on yes/no event contracts equalling $1, so anytime a user executes a Sell Order of a contract they already own, Kalshi credits $1 to your available funds.

Limit Order

Limit Orders allow users to buy event contracts on Kalshi at a set price (or better). Users can place a Limit Order to buy a set number of contracts at a specific price and the Kalshi platform will execute the trade as soon as the contract(s) are available at that price (or better). However, because the user is only requesting to buy contracts at the set price or better, there is no guarantee that the order will be executed immediately, or even at all. A Sell Order that does not end up being executed will become a Resting Order that other Kalshi users can trade with. Resting Orders on Kalshi are exempt from trading fees.

Limit Sell Order

The inverse of a Limit Order is a Limit Sell Order. These allow users to sell event contracts at specific prices (or better) whenever there is a buy order available to execute the trade at that price. Because these orders are only being executed at the set price or better, they will not always be traded immediately, or at all. Any Limit Sell Orders that are not executed will become Resting Orders (exempt from trading fees) available for Kalshi members to trade with.

Kalshi Event Trading Categories

Kalshi offers event trading options across a wide variety of categories including sports, weather, politics, financials, economics, culture, crypto, companies, tech & science, world, transportation, and more. The contracts for each category are yes/no outcomes for the event in question with the price of the event contract showing the probability of that event occurring.

Kalshi Sports Trading

Trade on sports contracts including both professional and college sports for a myriad of options like football, basketball, baseball, hockey, soccer, and so much more. Kalshi sports trading is available in 44 states throughout the country, whereas legal sports betting is not.

Weather

Kalshi provides weather contracts trading for climates all across the globe. Typically, these yes/no event contracts are based on a specific weather event to occur. an example could be for it to rain in a certain city, or reach a certain temperature.

Politics

Trade on the outcome of political events like an election result, Supreme Court case, cabinet appointment, a bill to pass, and much more. In 2024, Kalshi made a massive breakthrough when it became the first platform in over 100 years to offer regulated election trading nationwide. The demand for trading event contracts like the 2024 US Election was very apparent, as over $1 billion in election trades were made on the Kalshi platform.

Financial Markets

Trade on financial market results for major exchanges like Nasdaq, S&P, WTI oil, treasury daily yields, ODTE, Forex, and many more options.

Economics

Trade event contracts on economic events like a recession, inflation level thresholds, or a debt default.

Culture

Trade on culture markets like the Oscars, Grammy’s Rotten Tomatoes Scores, TIME Person of the Year, and so much more.

Tech & Science

Trade on Tech & Science outcomes and breakthroughs like the top iPhone app in the US, license grants for nuclear reactors, best AI, SpaceX launches, and the potential existence of aliens, to name a few.

Kalshi Approved for Brokerage Integrations

In a major recent breakthrough, Kalshi was approved to launch prediction markets on traditional financial brokerages. Soon, investors will have the ability to trade event contracts alongside all their financial market holdings like stocks and crypto, all from within the same portfolio.

The integration of Kalshi prediction markets on traditional financial brokerages will only increase the exposure of trading event contracts, as it will introduce an alternative trading method to so many already active investors. Expect to see Kalshi event contract trading options on popular platforms like Fidelity, Schwab, Robinhood, and others.

Kalshi App: iOS and Android

The Kalshi platform can be accessed in a website setting, but users also have the option to download the Kalshi app and trade from the convenience of a mobile device. The Kalshi app is available for download on both iOS (Apple App Store) and Android (Google Play) devices, offering widespread accessibility. The app is free to download and can be found in the Finance section of the aforementioned app stores.

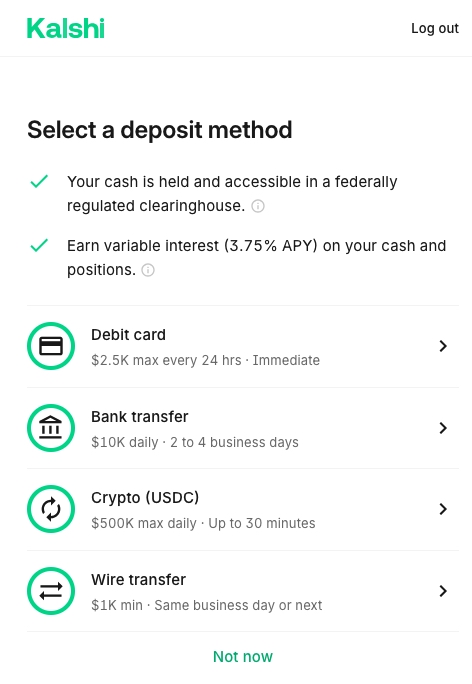

Kalshi Deposit Methods

Kalshi members have several options available to deposit funds into their accounts and execute trades. All deposited cash on Kalshi is held and accessible in a federally regulated clearinghouse. Users will also earn variable interest (3.95% APY) on their cash and positions on the Kalshi platform.

The available Kalshi deposit methods, their processing times, and deposit amount limits are as follows:

- Debit card (immediate, $2.5k maximum every 24 hours)

- Bank transfer (2 to 4 business days, $10k maximum)

- Crypto (up to 30 minutes, $500k max daily)

- Wire transfer (same business day or next, $1k minimum)

Kalshi Withdrawal Methods

Users also have the ability to withdraw funds from their Kalshi accounts when they have traded contracts and wish to pull out their cash. Deposited funds are initially locked for 7 days before allowing users to withdraw. Within 90 days of the deposit, users may only withdraw funds to that same account of deposit. After 90 days, users can withdraw to an account they did not deposit from. There is also a withdrawal minimum amount of $2.

The list of available Kalshi withdrawal methods, processing times, and potential fees are as follows:

- Bank account (can take 3-4 business days, no limits and no fees)

- Debit card (can take up to 30 minutes, $2,500 daily limit, flat $2 fee)

- Crypto (up to 30 minutes, $2,500 daily limit, variable fees depending on the amount)

Kalshi Event Trading FAQ

Some of the frequently asked questions pertaining to the topic of Kalshi Event Trading.

What can I trade on Kalshi?

Kalshi provides the ability to trade event contracts on yes/no outcomes for categories like Politics, Sports, Culture, Crypto, Climate, Economics, Companies, Financials, Tech & Science, Health, World, Transportation, and more.

What is the minimum age for Kalshi Event Trading?

The minimum age to use the Kalshi platform is 18 years old.

What states is Kalshi available in?

The Kalshi trading platform is available in 44 states offering nationwide coverage for prospective users. Kalshi is currently unavailable in Illinois, Maryland, Montana, New Jersey, Nevada, and Ohio.

Is Kalshi a federally regulated trading platform?

Yes, Kalshi is federally regulated by the Commodity Futures Trading Commission (CFTC).

Does Kalshi have an app?

Yes, the Kalshi app can be downloaded on both the iOS and Google Play store, providing access to users on Apple and Android devices.

When was Kalshi founded?

Kalshi was founded in 2018 and launched as an official trading platform in July 2021.

After years of writing as well as Data Analyst work for Pro Football Focus, Kevin Wolff is now a Sports Betting Writer for SportRadar, and more specifically, SBD. A graduate of Fordham University in NYC, Kevin is also a full-time dog dad when he's not writing.