Stock Market vs. Sports Betting: How Investing and Gambling Differ

Where is the boundary between investing in the stock market and gambling on sports? Is it a real and tangible, or is it an artificial construction? There are more than a few glaring similarities between the world of sports betting and participating in the global finance machine. More so than most people realize.

In this article, we set out to help you understand how the money poured into the stock market and into your sportsbooks aren’t all that different (except maybe how they’re viewed by the general public). With the right knowledge, a well-tuned skill set, and fastidious money management, both the stock market and sports betting can prove to be tremendously profitable enterprises.

Dispelling the Stigma of Sports Betting

The days of forking over an envelope of cash to a shady character in an alley are over. Sportsbooks are billion-dollar software conglomerates that allow you to place bets safely on your laptop and smartphone. The entire process of sports betting is simple, high-tech, and legitimate, and sites are engineered to provide top-notch experiences to clients.

The global market capitalization for sports betting is estimated at just under $60 billion per year, conservatively. Sports betting generates billions in real, clean wealth for both employees of sportsbooks and millions of bettors around the globe. Sounds a lot like the stock market, doesn’t it?

Sports Betting and the Stock Market: Fundamentals

When you look at them at their most fundamental, base level, sports betting and the stock market reward players for successfully predicting the future. Much like the stock market, sports betting isn’t all about wins and losses (ie. stock prices going up and down).

There are a ton of products designed to secure hedges for bettors (or investors), add liquidity to markets, and make markets more efficient for their participants. The difference between a call option and a futures bet isn’t that large.

Growth of the Market, Thanks to Sports Betting

Beginning in the late 1990s, sports betting surged due to the increased popularity of pro sports in the United States and Europe, as well as shifting regulations (thanks to the internet). The internet drastically altered the landscape sports betting, enabling sportsbooks to take bets over the web, rather than over the phone or in person. Subsequently, sportsbooks were able to reach millions of more people thanks to the connectivity that the internet offered. As such, the internet is primarily responsible for the sports betting industry’s explosive growth.

Sportsbooks constantly find innovative ways to entice bettors, with options like live betting, live streaming, and virtual sports betting. Even a few years ago, such features would have been inconceivable due to technological limitations, and they now make a substantial portion of the market. With internet access around the world burgeoning, the forecast for sportsbook is bright and possibilities are endless.

A whopping 25% of Americans admitted that they had bet on sports in the past year, while 48% of Americans (either actively or passively) had money in the stock market. Involvement in sports betting is trending up, and participation in the stock market has plummeted, declining 19% since 2002. Will we see convergence at some point? Only time will tell.

The Implications of Sports Betting’s Market Size

The size and continued growth trajectory of the sportsbook bring us to an important point: In the age of internet-driven business, you’re not betting against just your sportsbook anymore. You’re participating in a global marketplace with billions of dollars flowing through various books each day.

At a fundamental level, this is the same concept you see on Wall Street. You’re not playing against the house when picking a stock that you perceive to be undervalued and on the rise. You’re taking your valuation of it and betting against the market valuation. The same principle applies if you think that +110 for the Rangers over the injury-depleted Penguins is something that you can’t pass up on.

Event Trading: Where Sports Betting and the Stock Market Meet

Event trading apps are where sports betting and the stock market collide, as they allow you to invest in future sports (and other) outcomes as though you’re buying stock.

The 2024 presidential election, of all things, was what brought about the boom in event trading, as it’s not something you can bet on at a traditional sportsbook. Many took advantage of that on sites like Kalshi, buying event contracts on who would win. You can claim a Kalshi promo code and check out its offerings, which have now spread to single-game sporting events.

Sports betting vs. sports trading can feel like a blurry line, but when you look at the question, “what is event trading?” it becomes more clear. Essentially, you’re not betting against the house, you’re investing in the outcome of a future event, almost like buying a stock.

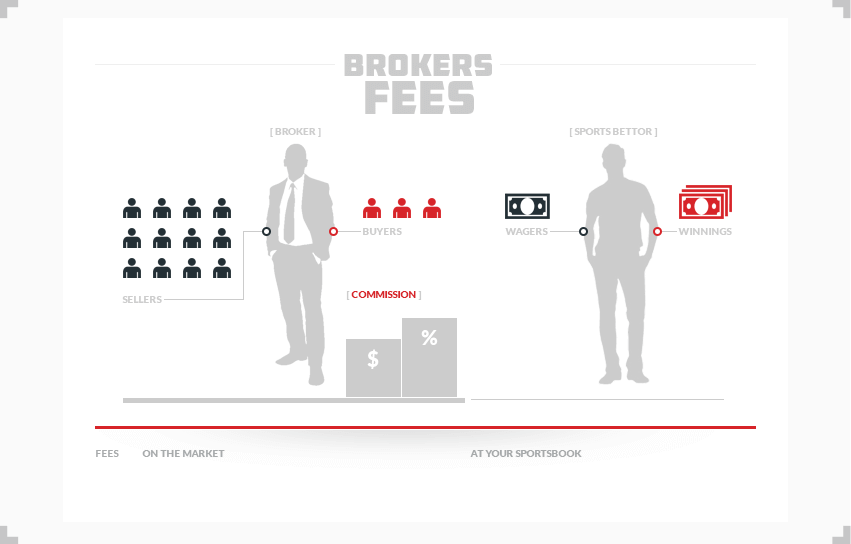

Paying to Play: Stock Market Fees vs. the Vig

In both the stock market and sportsbooks, you’ve got to “pay to play.” The vig is the sportsbooks “cut,” or the funds they take to run a viable business.

In the stock market, these would be considered various “brokers fees.” Brokers are intermediaries who connect buyers and sellers in the stock market, and the fees they charge for their service are called brokers fees. These commissions that brokers charge are usually a percentage of every transaction and come with both a considerably large capital requirement (often charged in both flat fees and percentages).

These rates vary widely and often depend on the complexity and nature of the financial operation the broker is facilitating. It can be difficult to overcome them as you maintain profitability, unless the capital you work with is substantial.

The “vig” is significantly more straightforward. In sports betting, you won’t find fees hidden deep within a complex structure like you would in the stock market, nor do you have to pass through any intermediaries. When placing sports bets, you do everything yourself, and as such the barrier to entry is a lot lower in sports betting than it is in the stock market.

If you’re looking for simplicity, stick to the sports betting market. It’s undoubtedly clearer than the infinitely-opaque and purposefully-oblique world of modern finance. As long as you understand the vig, there shouldn’t be any surprises. You’ve just got to bet the right way.

Animal Spirits and the Irrational Marketplace

John Maynard Keynes devised the framework for modern finance and was a significant player in the SEC (Securities and Exchange Commission), the regulatory body in the United States. He debatably saved capitalism in the 1930s with his ideas for an economic structure and recovery plan.

One of his lasting contributions to financial theory was his description of the driving force behind human instincts, preferences, and emotions that influence and guide human behavior in the stock market. Keynes theorized that the stock market wasn’t made up of rational actors making reasonable decisions. Instead, people acted impulsively, making decisions based on loyalty, hope, or greed. Keynes referred to these people as “animal spirits”.

Believe it or not, “animal spirits” did not, in fact, referring to the collective spirit of Philadelphia Eagles fans. In all seriousness, could a more perfect description of a “square” sports bettor be dreamed up? Probably not.

Do Your Research Before Buying and Betting

The majority of sports bets are placed irrationally, whether against the balance of probabilities, in light of contradictory information, or spontaneously. The same is true of the stock market. After all, there has to be some reason Bitcoin is worth over 10k (because we can’t come up with a coherent explanation).

People bet on sports with their hearts and not their heads. It’s a poor strategy, but it means that, for bettors willing to take a cautious approach, there are tremendous opportunities to exploit these marketplace inefficiencies. You don’t investment banks choosing funds and purchasing stocks based on sentimental value, and you’d be wise to follow their lead, ensuring every bet you make is backed up by cold, hard data,

Doing your research isn’t difficult if you know where to look – check out our team trends pages, which show you NFL ATS records (and for other leagues too) and allows you to track sports teams like investments, showing your return on investment for every past game and the season as a whole. Sharp allows you to evaluate a team’s value on the moneyline, point spread, and totals over time, considering their betting record in specific scenarios such as home favorite, away underdog, and more. It’s a great tool for those transitioning from casual betting to sports investing.

Home Bias: Exploiting an Inefficient Sports Betting Market

In the investment world, “home bias” refers to investors being over 3x more likely to invest in local firms, despite the known and quantifiable benefits of diversifying their portfolio regionally.

In sports betting, the manifestations of this are apparent. If the Cowboys are playing the Chiefs, the Cowboys are going to get significantly more money than the Chiefs, regardless of how enticing the odds price of these lines are. Simply put, sports bettors bet more money on their favorite teams, even if information clearly states it’s a poor choice.

What results is a disproportionately high percentage of wagers being placed on the Cowboys. This forces bookmakers to adjust the odds (and prices attached to them), in the hopes of encouraging action on the Chiefs. This evens the amount of money coming in from either side.

As sportsbooks artificially adjust their incentives to take one side or the other, they protect themselves from significant losses. This irrationality leaves room for intelligent bettors to employ rational, measured processes to determine the outcome of games.

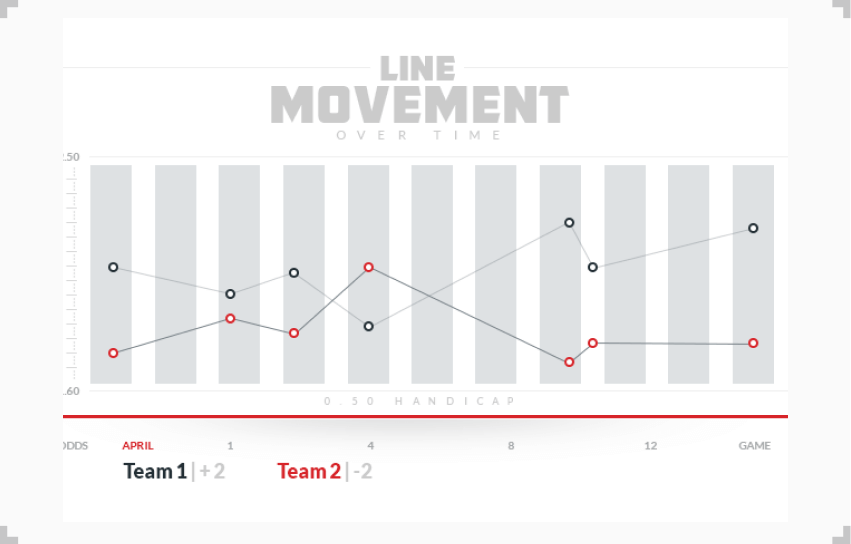

In the days after the initial line comes out, bookmakers feel the pressures of supply and demand, and they adjust the lines as the market reacts to internal and external forces, as well as new information.

IPO vs. Betting Line

In the stock market, institutional investors drive the prices of stocks. In publicly-traded arenas (like the equity market), institutional money is considered to be invested with more sophistication and precision, in comparison to their retail investor counterparts. Institutional money is the equivalent of “sharp” money.

The same isn’t true with sports betting, where the volume of “sharp” (think institutional) money usually pales in comparison to the volume of “square,” (think retail) money. Of course, there are intelligent bettors who don’t necessarily identify as professional bettors, but the number of these types of bettors is still dwarfed by the more “animal-spirit” square bettors.

As a result, there are a large number of price discrepancies for punters to exploit when looking for sports bets to take. The same amount of opportunity is not found as readily in the stock market. What this means is that a sports bettor equipped with the right knowledge can exploit these significant price discrepancies.

IPOs and Moving Betting Lines

An equivalent in the stock market of a changing betting line would be the pricing of an Initial Public Offering (IPO).

When a company goes public, the price range is set, and then continuously re-established based on the pressures of supply and demand. It could prove disastrous for the company if shares of the company were offered to the public without actually testing supply and demand during the initial stages (also known as the “roadshow”). The investment bank selling the shares are never allowed to decide what the price is, based purely on their own opinion.

When the stock goes public (“sharp”) investors can buy as many shares of the company as they want, so long as they believe the stock is undervalued. If the company was undervalued, they’d profit after the market inevitably corrected itself to reflect the true value of shares.

Conversely, if they believed that the stock was significantly overvalued, investors would have the opportunity to short the stock.

Mispricing IPOs doesn’t occur too often. There’s an army of businesspeople making sure that they can get the price closest to “true” market value as possible.

Mispriced Lines Exist with Sportsbooks

The same is not valid for sporting events. There are hundreds of mispriced lines available every single day.

What makes sports betting really significantly different than the standard market fluctuation of stocks is that bookmakers are fine with purposefully mispricing events. Sportsbooks aren’t interested in offering lines that are “fair.” Their exclusive desire is a balanced book that has an equal amount of bets on either side of the outcome. Again, this inherent flaw in the pricing of sports events provides massive opportunity.

Where Sports Betting Reigns Supreme: Access and Accessibility of Information

The sports world is far more transparent than the world of finance. While there are tons of complicated systems for analyzing prospective outcomes of sporting events, their complexity still pales in comparison to the opacity of global finance.

In 2008, an overreliance on Collateralized Debt Obligations (an incredibly complex derivative product of mortgage bonds) caused one of the worst financial collapses in world history. Only the sharpest minds in finance can really understand what collateralized debt obligations are, why they failed, and how this failure caused the greatest recession of the 21st century.

As complicated as the NFL’s DVOA (Defense-adjusted Value Over Average) is, it’s a lot more penetrable than understanding financial products PhDs in Mathematics have engineered.

When it comes to sports, it’s easy to get the critical information that’ll have a prominent effect on the outcome of your bets. Injury reports are available for nearly every sport, allowing you access to the information that dictates whether key players will be playing or not, as well as what level they’re likely to perform at.

Further, there are thousands of news and sports media companies providing full game sheets of relevant information, with verifiable statistics that you can study yourself. All the data is there for you to research and analyze yourself, with whatever methods you decide will help predict sports winners.

Where the Stock Market Pales in Comparison

Monitoring the performance of various financial products is significantly more difficult than understanding sports outcomes. It’s commonly accepted that some stocks aren’t really fully understood by the people selling them.

It’s impossible to list them all the possible mitigating factors that can stand to affect the stock price. Geopolitics, local elections, consumer debt, and uncountable, unrelated events can significantly affect the prices of stocks.

The most liquid asset in the entire world is S&P 500 futures. These can be bought on sold on an exchange in mere minutes. What’s so great about sports betting? Any bet you make is just as liquid as the most liquid asset on the entire stock market. Plus, you never have to worry about troublesome things like bid-ask spreads. You know what your potential ROI and losses stand to be as soon as you confirm your bets.

Even if you’re just purchasing equities, companies have many, many ways to manipulate their numbers legally, to give you a different picture of reality. Further, insider trading is commonplace in the stock market. It’s definitely much more common than match-fixing, to be sure.

With sports betting, you’re not going to lose your chance at profitability if the entire market sees a major drop. You’re betting in a global marketplace, but your money is always safe from external pressures (so long as you’re using a reputable sportsbook).

Parting Thoughts

Sports betting — and its comparisons with the stock market — can act as an excellent conduit to becoming more financially literate. Always remember, however, that when it comes to your bets, nothing will pay off more than educating yourself adequately. Research, analysis, and deep study are integral to becoming a successful bettor. There are no shortcuts. Don’t let your animal spirits get the best of you.

Sports betting is only getting bigger and bigger, with more and more liquidity and decreased transaction costs and fees. There’s never been a more enticing time to get involved in the ever-growing industry.

Evergreen Manager; Sportsbook Expert

Following a sports journalism career with his work appearing in outlets like theScore, The Province, and VICE Sports, Patrick moved into the world of content marketing to bridge the gap between great writing and SEO success. He’s brought that same mindset to lead evergreen content efforts at SBD.