Sports Betting Overcame COVID for a Record Year in 2020

2020 forced individuals and businesses to adapt in unique ways. Despite unprecedented challenges, COVID-19 brought innovation and human resiliency to the forefront.

For the first time in living memory, the sports world was virtually shut down throughout much of the spring. So, what did all this mean for the US sports betting industry less than two years after legalization? We looked at the reported economic data from states across America, and it turns out not even a pandemic could stop the growth of legal sports betting.

Read on for a deep dive into how the sports betting industry weathered the COVID storm in 2020. We’ll explore the latest trends in the business of sports betting in the United States and consider what 2021 may have in store for bettors across America.

Sports Betting Bloomed During COVID-19

In 2020, six new states launched legal sports betting operations, while five others legalized the activity but have not yet taken wagers.

With legal sports betting available in more states than ever before, it should come as no surprise that business is booming.

Overall, the third calendar year of legal sports betting activity in the US saw more money wagered and higher revenues than ever before. More than $240 million wound up back in state treasuries.

The table below illustrates the rapid expansion of the sports betting industry and year-over-year economic growth. The figures represent the totals reported by all states, but we must note that some states do not release certain data.

Additional notes:

- Handle refers to the total amount wagered on sports

- Revenue reflects the gross gaming revenue kept by sportsbooks after paying out winning sports bets

- State tax revenue refers to the taxes collected by state and local jurisdictions or the state’s share of the proceeds in revenue-sharing markets

| Year | Number of States | Total Handle | Total Revenue | Total State Tax Revenue |

|---|---|---|---|---|

| 2018 | 8 | $4,618,927,032 | $328,876,857 | $39,128,263 |

| 2019 | 14 | $13,070,894,561 | $915,172,754 | $127,364,114 |

| 2020 | 20 | $21,526,970,899 | $1,545,524,400 | $244,621,474 |

Despite the many challenges of the COVID-19 pandemic, the sports betting industry showed no signs of slowing down in 2020. Let’s take a look at some of the key trends that emerged in the sports betting market over the past year.

Sports Betting Market Trends in 2020

Sports betting data is full of insights for investors, casual observers, and sports fans interested to see how the industry develops. As the market continued to take shape in 2020, some clear trends have emerged that are worth noting.

Online Betting Continues to Dominate the Market

Some states with legal sports betting allow wagering via online betting sites and mobile devices, while others require bettors to visit a retail sportsbook or casino to place their bets in person. Needless to say, one of these options is far more convenient and accessible than the other, especially amid a pandemic.

Online betting was already responsible for the majority of betting handle in 2019, and COVID-19 accentuated the difference in 2020. States that offer online betting performed significantly better than states that do not.

As such, COVID-19 may have helped speed up states’ approval of online betting and sent a clear message to lawmakers in states still waiting on the sidelines. Removing barriers to mobile betting, such as lifting in-person registration requirements, also paid off in states such as Illinois. This probably would have happened eventually, but retail location closures likely quickened the process. Don’t be surprised if more state legislatures make mobile wagering more accessible soon.

New Powerhouse States Emerge

Several new states came to market in 2020, but Colorado, Illinois, and Tennessee made the biggest splash. Each surpassed the $100 million mark in monthly sports betting handle consistently towards the end of 2020, so we expect them to post big numbers in 2021.

Furthermore, the emergence of strong new markets beyond traditional gambling-friendly locales suggests that sports betting is gaining wider acceptance and popularity thanks to the availability of safe and legal options.

Colorado

Colorado sports betting went live in May 2020 and quickly gained steam, taking over $200 million in wagers each month from September onwards. Colorado’s sports wagering laws are among the most progressive in the nation. With very few restrictions and more than a dozen online sportsbooks available within the first six months, sports fans in the Centennial State had plenty of ways to get in on the action and wasted no time doing so.

Illinois

Illinois’ sports betting market stumbled at first, in part due to unlucky timing. However, the Prairie State saw explosive growth after lifting in-person registration requirements for online sports betting in August 2020. Illinois finished the year with nearly $2 billion in bets placed, making it the nation’s fourth-largest market.

Tennessee

Tennessee launched late in 2020 and is off to a scorching start. With its unique online-only betting market, the Volunteer State reported over 100 million in handle in each of its first two months. Not even New Jersey can claim that.

A New Number One

Speaking of New Jersey, the Garden State surpassed Nevada’s annual sports betting handle for the first time in 2020. This is significant as Nevada had a decades-long head start on other states to build its legal sports betting industry.

New Jersey moved slightly ahead over individual months back in 2019, including May, July, and August. However, NJ finished 2019 with more than $700 million less in handle than Nevada.

Fast forward to 2020, and New Jersey consistently outdid Nevada in terms of betting handle every month, accumulating over 1.6 billion dollars more in sports bets than Nevada. Clearly, Vegas was hit hard due to casino closures and a reduction in domestic and international tourism.

Interestingly, while COVID-19 may have helped advance New Jersey’s cause, looking at January and February numbers from before the declaration of a pandemic, it appears NJ was likely to have moved into the number one spot regardless. It’s worth noting that mobile betting handle accounts for more than 80% of New Jersey’s total – a distinct advantage over Nevada, which has stricter rules for online betting and relies heavily on the Las Vegas Strip.

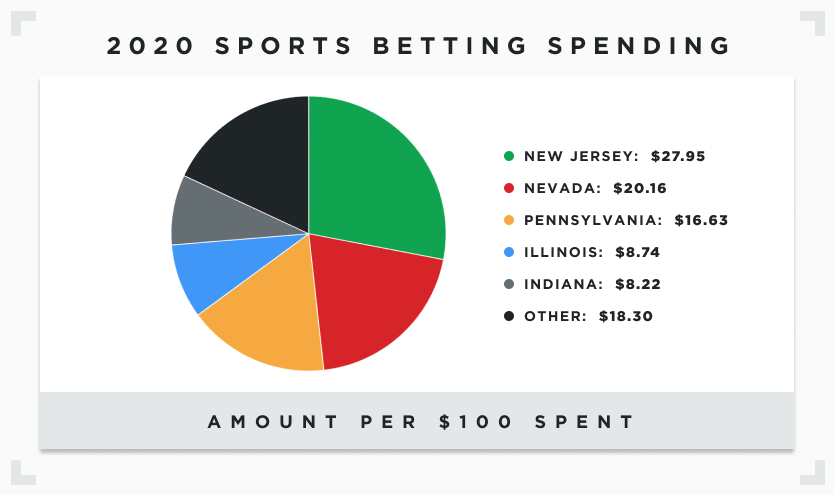

Here are the six biggest sports betting markets in the United States based on 2020 handle:

- New Jersey – $6,016,968,399

- Nevada – $4,340,581,339

- Pennsylvania – $3,580,864,477

- Illinois – $1,882,363,604

- Indiana – $1,769,270,606

- Colorado – $1,185,754,618

No other state surpassed the $600 million mark in 2020, which means the sports betting market is still heavily concentrated in a few key states. To illustrate this in more detail, here’s a look at where money is being laid down in America. For every $100 bet on sports, this is where the action occurred:

We expect this trend to change in the future as new states come to market or move to allow online betting. Remember that America’s three most-populated states – California, Texas, and Florida – have yet to legalize sports betting, while New York sports betting is still limited to in-person wagers.

With populations of over 20 million people each, legalization of online betting in any of these states would undoubtedly create one of the biggest sports betting markets in the country. Not to mention that together, California and Florida account for all four reigning champions in the major leagues – the Tampa Bay Buccaneers, L.A. Lakers, L.A. Dodgers, and Tampa Bay Lightning all took home titles in 2020. One of the biggest sports brands to launch their own betting app is ESPN BET, new users can sign up with an ESPN Bet promo now.

2020 Winners and Losers in Sports Betting: State-by-State Comparison

2020 brought in sustained growth in sports betting revenue nearly everywhere legal sports betting is available. Just three states saw their revenues decrease from 2019 to 2020 – Delaware, Mississippi, and Nevada.

Notably, Nevada’s total handle was higher in 2020 than in 2019. The fact that the Silver State had less gross revenue than the prior year means that bettors cashed in at a higher rate. In fact, Nevada was the friendliest state in that regard, with just a 6.07 percent hold, which reflects how much revenue sportsbooks keep as a function of the betting handle.

On the flip side, Rhode Island had less overall handle in 2020, but higher revenue than 2019. Still, RI’s 10.85 percent hold pales in comparison to the staggering 16.82 and 18.94 hold percentages in Washington, DC and Delaware, respectively.

A high hold rate means sportsbooks are keeping more money for every dollar wagered. Hold rates are variable and not completely within the realm of control for sportsbooks or state governments. Factors such as bet balance, an inflated vig, or bettors flocking towards futures markets can all drive up the amount that sportsbooks profit. At the end of the day, a high hold percentage is bad news for bettors. It can be worth checking to see if you’re getting a fair shake at your sportsbook or within your state.

Here are the key figures for each state in 2020.

| State | Total Handle | Revenue | Hold Percentage | State Tax Revenue |

|---|---|---|---|---|

| Arkansas | $32,882,808 | $4,191,640 | 12.75% | $583,374 |

| Colorado | $1,185,754,618 | $75,841,206 | 6.40% | $2,964,672 |

| Delaware | $90,242,755 | $17,096,405 | 18.94% | $12,043,312 |

| Illinois | $1,882,363,604 | $125,494,792 | 6.67% | $20,191,143 |

| Indiana | $1,769,270,606 | $137,277,099 | 7.76% | $13,041,325 |

| Iowa | $575,239,746 | $41,629,263 | 7.24% | $2,806,655 |

| Michigan | $130,763,498 | $18,276,857 | 13.98% | $1,535,256 |

| Mississippi | $363,775,648 | $43,741,530 | 12.02% | $5,256,453 |

| Montana | $17,779,330 | $2,450,769 | 13.78% | $2,450,769 |

| Nevada | $4,340,581,339 | $263,340,000 | 6.07% | $17,808,056 |

| New Hampshire | $292,594,088 | $23,637,613 | 8.08% | $11,000,815 |

| New Jersey | $6,016,968,399 | $398,521,093 | 6.62% | $50,891,397 |

| New Mexico | — | — | — | — |

| New York | — | $10,768,736 | — | $1,094,832 |

| Oregon | $218,246,357 | $20,072,367 | 9.20% | — |

| Pennsylvania | $3,580,864,477 | $269,902,733 | 7.54% | $81,374,898 |

| Rhode Island | $221,916,076 | $24,067,477 | 10.85% | $12,274,413 |

| Tennessee | $312,344,523 | $27,144,908 | 8.69% | $5,443,918 |

| Washington, DC | $80,527,761 | $13,548,201 | 16.82% | $1,008,014 |

| West Virginia | $414,855,266 | $28,521,711 | 6.88% | $2,852,172 |

| Total (2020) | $21,526,970,899 | $1,545,524,400 | 7.18% | $244,621,474 |

Of course, just because annual totals were up in most places doesn’t mean there weren’t some difficult months for sportsbooks in 2020.

Month-by-Month Sports Betting Activity in 2020

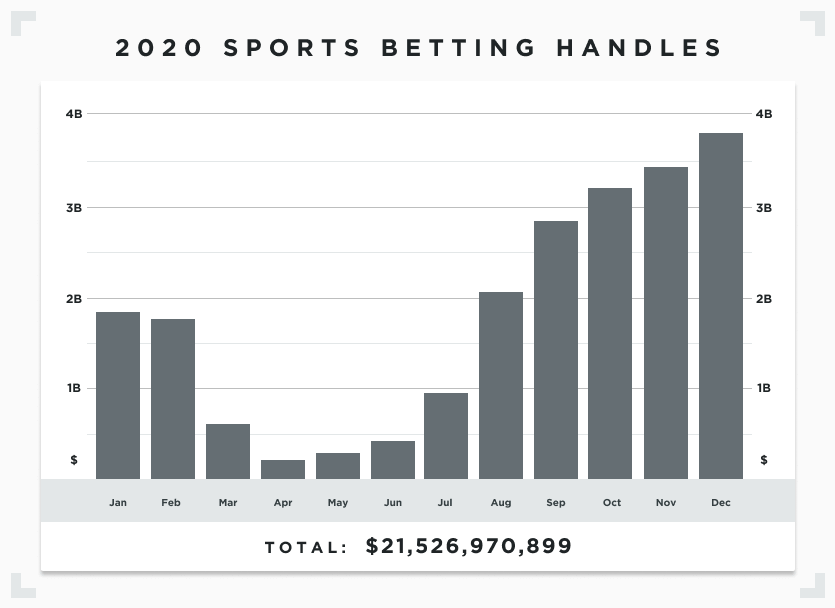

It’s well-known that the coronavirus pandemic hit some states harder than others and at different times. Furthermore, few North American sports were played in the spring months, which naturally led to a dip in sports betting activity. All the major leagues suspended play, the NCAA canceled spring 2020 national championships, and international events were put on hold. Even the Olympics were pushed back a year.

When sports returned, athletes, teams, and leagues had to adapt to new routines, including bubbles, wubbles, remote broadcasts, and thousands of COVID tests. Many sports were played without fans in attendance, and sometimes without key players, too. Judging by the uptick in betting handle, it seems placing a wager represented a way for fans to feel closer and more engaged with the action while staying home.

Here’s a look at monthly sports betting revenue totals in 2020 for all states combined.

| Month | Total Handle | Total Revenue | Hold Percentage | Total State Tax Revenue |

|---|---|---|---|---|

| January 2020 | $1,788,260,374 | $139,932,628 | 7.83% | $23,016,306 |

| February 2020 | $1,714,626,537 | $84,206,523 | 4.91% | $24,703,927 |

| March 2020 | $607,988,102 | $35,330,216 | 5.81% | $6,280,624 |

| April 2020 | $140,244,134 | $8,384,269 | 5.98% | $1,707,752 |

| May 2020 | $342,864,090 | $26,475,596 | 7.72% | $4,017,279 |

| June 2020 | $447,662,470 | $29,682,272 | 6.63% | $5,126,081 |

| July 2020 | $909,758,986 | $73,011,358 | 8.03% | $9,864,777 |

| August 2020 | $2,192,424,918 | $126,586,653 | 5.77% | $17,908,518 |

| September 2020 | $2,875,068,662 | $154,358,367 | 5.37% | $18,822,193 |

| October 2020 | $3,254,941,875 | $281,009,928 | 8.63% | $43,725,136 |

| November 2020 | $3,464,334,989 | $310,926,587 | 8.98% | $47,174,614 |

| December 2020 | $3,788,795,762 | $275,620,003 | 7.27% | $42,274,267 |

| Total (2020) | $21,526,970,899 | $1,545,524,400 | 7.18% | $244,621,474 |

Interestingly, the best month in terms of the amount wagered on sports was December 2020. Sports bettors laid down over 3.7 billion dollars, a new monthly record. This record total is somewhat surprising given both the MLB and NHL were in their offseason in December, and the NBA didn’t return until halfway through the month. By contrast, all the major leagues were playing simultaneously in September.

This surge late in the year may simply reflect newly legalized states gaining momentum, but it also suggests the NFL is still by far the most popular sport to bet on in America.

November was the second-highest month in terms of handle, but sportsbooks, and consequently the states, retained their highest revenues after paying out winning bets. The November hold of 8.98 percent was nearly double that of February 2020 (4.91 percent). Nevada, typically a bettor-friendly market, pushed above a 10 percent hold for the first time since we began tracking this data in 2018.

April was the hardest month for the industry, with just $140 million in wagers placed. There were few sports to bet on as the country dealt with the first wave of COVID-19 infections.

As you can see from the graph above, the industry rebounded in a big way throughout the summer and into the fall. Year-over-year, August, September, October, and December 2020 all saw monthly betting handles more than double from 2019. August topped all months with a whopping 193 percent growth over the previous year.

Looking Ahead to 2021

The future of sports betting in America looks bright, and 2021 is already off to a huge start with the launch of online sports betting in Virginia and Michigan in January. There’s a good chance Maryland, Washington, South Dakota, and others start taking bets in the coming months.

With plenty of lessons learned during 2020 and new markets developing, the US sports betting industry is primed to be even more competitive in 2021. This is great news for bettors as more competition leads to more appealing odds and better promotions.

Whether you’re new to the action or looking to take your sports betting skills to the next level, Sports Betting Dime will help you find the best sportsbook for you and give you all the tools and information you need to bet on sports with confidence.

We’ll also help you stay up to date with an industry that’s constantly changing. Refer to our Research section for in-depth insights and analysis from the world of sports betting. Be sure to check out our state-by-state revenue tracker for the latest financial figures.

Have fun and enjoy the action out there!

Evergreen Manager; Sportsbook Expert

Following a sports journalism career with his work appearing in outlets like theScore, The Province, and VICE Sports, Patrick moved into the world of content marketing to bridge the gap between great writing and SEO success. He’s brought that same mindset to lead evergreen content efforts at SBD.